Research Brief

The impact on jobs and earnings of offshoring in South Africa

The success of an economy’s manufacturing sector is often critical to economic growth and development. As a major contributor to exports, site of innovation, adopter of international best practices, and engine of job creation, an internationally competitive manufacturing sector often drives output and employment growth.

In South Africa, when firms in the manufacturing sector move production offshore the overall level of employment decreases

In contrast to the experiences of developed countries, the percentage of skilled workers employed shrinks as firm-level imports rise

The percentage of unskilled workers employed increases especially in ultra-labour-intensive industries as firms increase their imports, indicating that offshoring in the economy is more likely to reduce skilled manufacturing than unskilled manufacturing jobs

Earnings increase for remaining employees at labour and capital-intensive firms that offshore production, but decrease for workers at ultra-labour-intensive firms

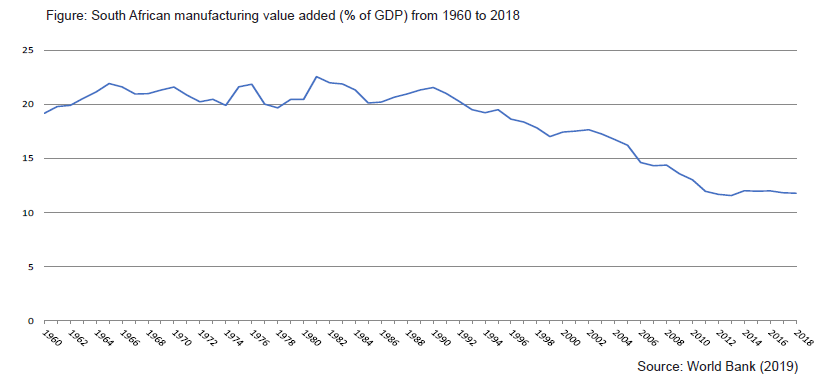

In South Africa, though, the manufacturing sector’s contribution to GDP has been steadily declining. This has been a common feature of Southern African countries, causing widespread consternation among experts who fear that a deindustrializing trend could stall development efforts. The share of South Africa’s manufacturing output, relative other sectors, has decreased steadily since the early 1990s — a development which has coincided with the globalization or fragmentation of production networks.

More and more, South African manufacturing firms import intermediate inputs instead of producing them on shore. This combined with poor productivity performance and their declining share of domestic manufacturing has contributed to the country’s high level of unemployment. From 2005 to 2014, approximately 250,000 jobs were lost in the sector.

How does offshoring affect employment in South Africa?

Increased offshoring, measured by firm-level imports, was found to be associated with an overall decrease in employment in the manufacturing sector. Furthermore, the number of skilled workers in the manufacturing sector decreases both absolutely and as a share of the total employed in the sector as offshoring increases.

This finding shows that the effect of offshoring in South Africa is different than might have been expected, based on the experiences of more advanced industrial countries. In other countries, the relocation of production has reduced manufacturing employment overall, but there was also an increase in the share of skilled workers relative to unskilled workers.

Based on this, it is often thought that manufacturing firms offshore by moving low-skilled and low-wage jobs elsewhere. While this reduces low-skilled employment, firms are generally expected to reinvest the gains in higher value-added production, which would increase demand for skilled workers and raise wages in the sector. This has not happened in South Africa.

Recent evidence suggests that offshoring by ultra-labour-intensive industries — such as textiles, foods, leather goods, and furniture — have a more dominant effect on overall employment in South African manufacturing than do the offshoring activities of other firms. In particular, narrow offshoring by these firms, when firms begin to import items they previously produced, actually increased employment in low-skilled or low-wage jobs, indicating that in South Africa’s labour-intensive industries, it is higher-skilled jobs that are outsourced.

As this finding suggests, offshoring affects jobs and wages differently in different industries. With the recent availability of firm-level tax data, new research opportunities exist to explore these differential impacts.

How does offshoring affect employment earnings?

For example, narrow offshoring increases the cohort of unskilled workers in South Africa’s ultra-labour-intensive industries. However, narrow offshoring in labour-intensive or capital-intensive industries has the opposite effect. Likewise, the association between broad offshoring, measured as the total value of all imported inputs, and the ratio of skilled to unskilled jobs was not equally strong. The difference between these two specifications is that the measure for narrow offshoring reflects more directly the outsourcing of production.

The growth in offshoring activity by South African firms was also found to be associated with modest increases in workers’ earnings for both capital- and labour-intensive industries, but not for ultra-labour-intensive industries where earnings decreased.

Overall, earnings decrease as the result of increased offshoring, but the affect is generally stronger for lower-wage or lower-skilled workers in labour-intensive industries than for highly-skilled or highly-paid workers in capital-intensive industries who may see earnings increase. Again, the overall labour market impacts of offshoring in the South African manufacturing sector seem to be dominated by the impacts and activities of ultra-labour-intensive industries.

Policy considerations

The results support the need for a balanced policy approach, which does not abandon a supportive environment for higher-skilled advanced manufacturing firms, but that recognizes the more employment-intensive growth potential of lower-skilled and labour-intensive manufacturing industries

A continuation of recent policy, such as the Industrial Policy Action Plan, is substantiated

Specific sectors and niche markets need to be identified and supported through targeted programmes and nuanced support through the entire value chain; e.g. the clothing, textiles, leather, and footwear industries

Overall, manufacturing firms in South Africa shed jobs when they offshore. If narrow offshorers increase their imports, the percentage of skilled workers declines, but unskilled jobs increase. From a South African employment perspective, these results might be interpreted as encouraging, given South Africa’s large semi- and unskilled workforce.

A balanced approach is needed to create a supportive environment for higher-skilled advanced manufacturing firms, but continued support for labour-intensive firms could help to create entry-level employment positions for less skilled workers.

More research is needed, particularly on the impacts of offshoring by manufacturing firms that are part of multinational corporate structures. There may be policy lessons to be learned, especially regarding the automotive industry and the support it receives in South Africa.

Join the network

Join the network