Blog

International tax research

Why does more than numbers matter

Can tax research be inspiring? Looking back at the three years of collaboration between UNU-WIDER and the Uganda Revenue Authority (URA), the answer is yes – but even that is just the start.

Our joint research and capacity-building programme carrying out analysis of tax administrative data has yielded research that helps design fair and efficient tax policies. The results have been presented in academic conferences and policy workshops. However, the key element in the collaboration which aims to make a concrete difference is that research activities are planned together and the research papers are co-authored.

Evidence to guide policy making

The programme’s research has covered topics of tax compliance, formalization of businesses, and personal and corporate income taxation. Through this work, we hope to see improvements in the accuracy, focus and coherence of policy decisions taken in Uganda.

In Uganda, 87% of all workers operate in the informal sector. These people do not pay taxes and are in a precarious position in the job market. We want to provide advice for policies that help reduce the size of the informal sector, so that these people will be able to meet their tax obligations and be eligible for social benefits.

Increasing the overall amount of taxes collected is also important, so that the state will be able to provide better social protection to all its citizens and improve the welfare of households. Approximately 40% of the population in Uganda must cope with less than USD1.9 per day. Well-designed tax policies will help in addressing the inequality among households as well.

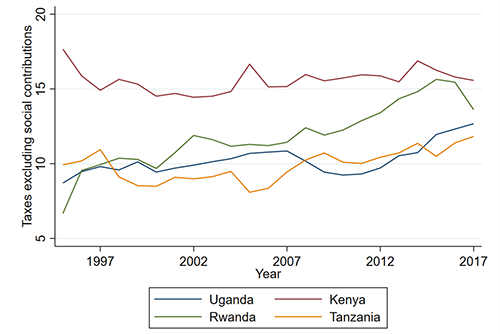

In 2017, Uganda’s tax revenue was 12% of GDP, which is low compared to neighbouring countries. In Europe, the average tax revenue is around 24% of GDP. Ugandan government has set ambitious goals to increase the tax revenue to 14.3% of GDP in the 2020/21 financial year. With our research and analysis results we truly have a chance to make a difference.

Recently we carried out for instance an analysis of the impacts of the tax policy reform which increased taxes of highest wage-earners and cut tax rates of lower wage-earners, to see if it had an impact on employees’ income and paid taxes.

Personal engagement makes a difference

The close collaboration has proven to be valuable to both partners.

At UNU-WIDER, researchers have gained a better understanding of the Ugandan country context. Working together with URA’s researchers from the outset has helped us shape relevant research questions and successfully interpret the local tax rules.

In turn, at URA, the research department is now able to put into good use the digital tax data already collected for over 10 years. In addition to technical training sessions, we have a chance to write research and have one-to-one brainstorming with experts in Europe.

Since the collaboration started, URA has had more engagement with other institutions to drive economic changes in Uganda. Silos have started breaking down. Nowadays we have collaborative projects with a nice blend of economic and policy research, and connections with both the researchers at the Makerere University and with international partners.

The use of data to support policy decisions is now becoming a common practice at URA. The demand for evidence is higher now than before this collaboration. In the future, we wish to see the data used not only for research purposes but also locally at the URA to evaluate our operations and performance.

The collaboration with UNU-WIDER has been supported by a range of digital tools that have enabled us to communicate with partners located in different countries. During the COVID-19 pandemic, knowing how to use the online platforms has proven essential for continuing the research work and trainings.

COVID-19 highlights the importance of the collaboration

The current pandemic underscores the need to design tax and benefit policies wisely. In many countries the pandemic is likely to make the informal sector larger and push more people into poverty. Tax policies can be an important tool in supporting the wellbeing of the citizens even in a crisis like this.

During the pandemic, the ability to analyse the existing data at URA has been more vital than before. We have used the data analysis to identify which sectors we can leverage on for revenue generation, and as a guide for designing the tax policy measures – such as changes in VAT and personal income taxes - in the national COVID-19 stimulus packages.

As the programme continues, we will develop our research agenda further so that it continues to be relevant today as well as in the future.

Hopefully we can soon meet again in person too.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network