Blog

The value of non-renewable resources in the era of climate change

The economic decline of Nauru, an island in the Central Pacific, is a cautionary tale. Nauru was the highest GDP per capita country in the world in the 1970s, due to the value of its phosphate deposits. A few decades later, the country reached the brink of economic collapse when its phosphate deposits ran out. Phosphate extraction had eroded the island’s arable land and destroyed its agricultural potential.

In this context, what was the true value of Nauru’s phosphate reserves? Should we argue that they had negative value in the long term? Should we have discounted the lost environmental value from its 1970s GDP and phosphate reserves?

In the context of today’s climate crisis, those questions still bear high relevance. Policy makers are ill-equipped to assess the real value of the resources they have in the ground. Resource valuation practices matter because they influence the decision to extract natural resources, as well as how resource revenues are mobilized to foster economic development.

In a recent study, I suggest that a rethinking of the valuation of extractive resource wealth is much needed. In the context of the upcoming COP26 Summit, countries whose economic development strategies rely on the revenues from natural resource extraction are less amenable to the calls of environmentalists to leave these resources in the ground. Reducing their valuation to properly reflect environmental and other costs, while providing international compensation for lost revenues, might help change their minds.

Beyond discounting the cost of greenhouse gas (GHG) emissions

Existing measures of extractive wealth resemble GDP in the sense that they are a misleading indicator in the context of the ecological crisis. Discounting the cost of GHG emissions from extractive rents is a promising first step towards improving resource measurements but is not sufficient. Only discounting the carbon footprint may not give justice to the loss of future income streams (opportunity income) caused by environmental degradation.

For example, Bolivia’s Salar de Uyuni salt flat is the largest source of lithium in the world. Nevertheless, lithium extraction has clear trade-offs. Water consumption for lithium extraction and crop irrigation (which sustains the livelihoods of local populations) cannot simultaneously take place. Lithium extraction will also threaten tourism revenues, as the salt flat is the most visited ecotourism attraction in Bolivia.

The (intangible?) value of biodiversity and human livelihoods

In many contexts, there are also intangible costs. Extraction can cause destruction of human livelihoods (such as the water resources threatened by shale gas extraction in Algeria), and to fauna and flora, which raises the issue of how to value the existence of a plant or an animal. It can also endanger spiritual sites, as illustrated by the sacred aboriginal site recently blown up by the mining company Rio Tinto in Australia. There are no obvious ways to quantify the intangible value threatened by extractive activities, but such issues should be considered in extractive wealth valuation.

International compensation for the cost of keeping resources in the ground

There are problems in operationalizing better measurement at the national and global level. Everyone benefits from biodiversity protection and reduced emissions, but the economic burden of maintaining extractive resources in the ground disproportionately affects local populations. International action and co-ordination are therefore needed to compensate states for the protection of environmental assets, especially in developing countries that hope to mobilize revenues for socioeconomic development. In that sense, the Yasuní ITT initiative in Ecuador, despite its failure, can constitute a relevant source of lessons.

Implications for policy makers: to extract or not to extract?

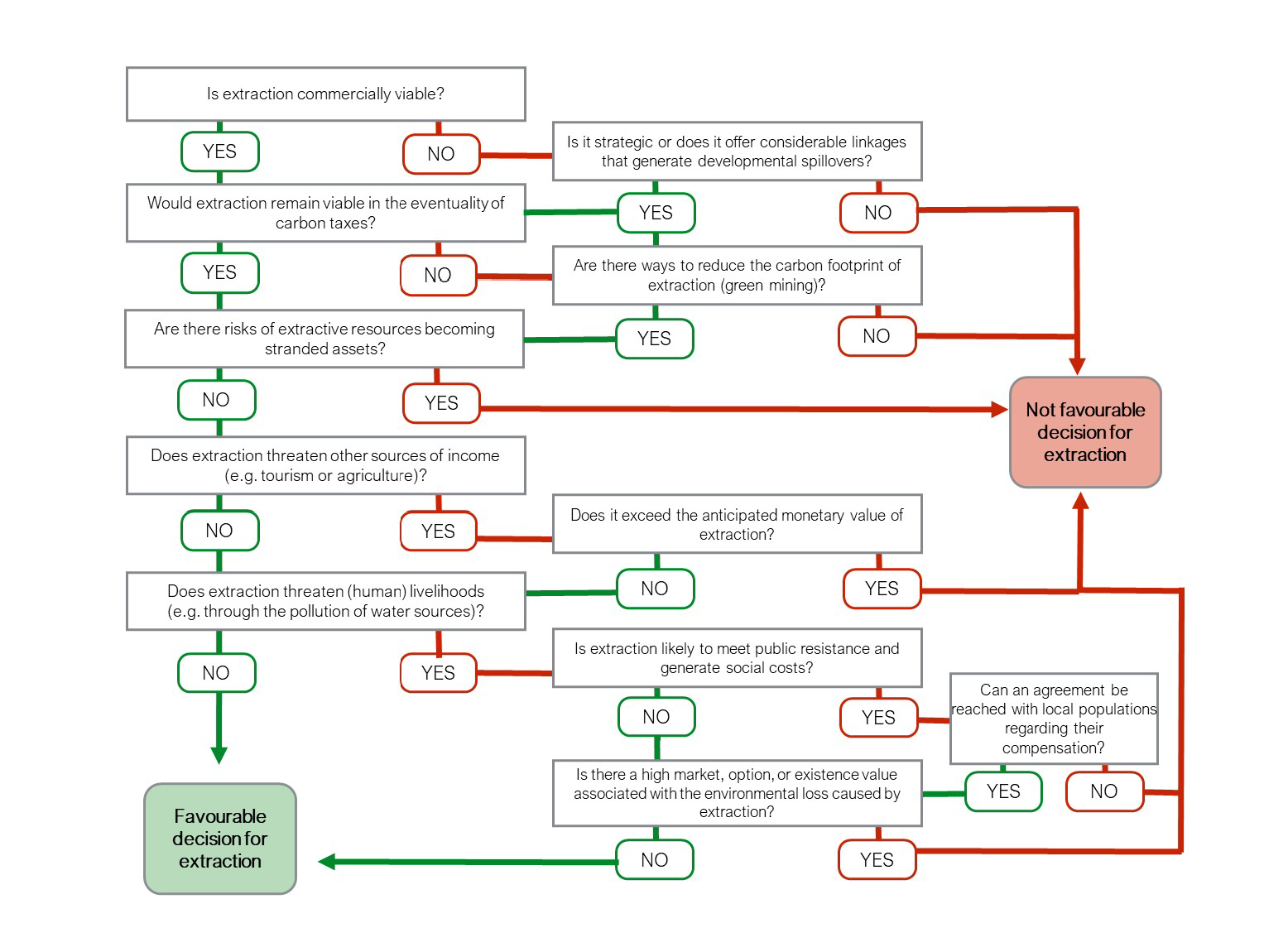

Decisions on the value of extractive wealth can be informed by a decision tree, such as in Figure 1. Beyond deciding whether extraction is commercially viable or serves a broader developmental purpose, policy makers need to assess whether extraction revenues are threatened by the eventuality of carbon taxes, whether extractive resources are at risk of becoming stranded — meaning the investments made are lost when the extractive project becomes unprofitable — and whether the opportunity cost of extraction is higher or lower than the income generated.

Figure 1: The extraction decision tree

Finally, policy makers need to assess the extent to which extraction threatens livelihoods, both human and non-human. If extraction is likely to meet social resistance (social conflict arising from a lack of social acceptance of mining activities incurs higher costs), policy makers need to carefully consider whether a compensation for the loss of human livelihoods is possible, and whether its costs would exceed the benefits of extraction.

A better methodology to assess the true value of extractive wealth can allow for more transparency in extraction decisions and empower civil society. Indeed, given that a policy maker may be more interested in the next 10 years of oil revenues than the next 100 years of environmental consequences, providing researchers and civil society with better tools for evaluating the true value of resource wealth is evermore essential.

Dr Amir Lebdioui is the Canning House Research Fellow at the London School of Economics (LSE). He is also an associate at the Grantham Research Institute on Climate Change and the Environment. He was previously an affiliated lecturer in Development Studies at the University of Cambridge. He tweets at @amirlbd.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network