Research Brief

Did withholding value-added tax improve revenue collection in Zambia?

Along with several other African countries, Zambia has introduced a withholding system for value-added tax (VAT) to improve revenue collection and compliance. Even though VAT withholding policies are applied in several countries in Africa and similar industry-specific policies in Europe, empirical evidence on the impacts has been scarce. An analysis taking advantage of tax administrative data shows that in Zambia the withholding system increased the reported VAT of firms trading with withholding agents.

The system to assign selected large firms and public entities to withhold and remit value-added tax (VAT) on input purchases from other firms successfully increased VAT revenue

At the firm level, the introduction of VAT withholding increased the reported VAT of firms trading with these selected large firms and public entities (withholding agents) by approximately 10%

Furthermore, the reform increased the probability of filing VAT — firms that had some of their VAT withheld were at least 13% more likely to file their VAT return

The withholding system was very successful in increasing VAT revenue. A coarse estimate of the impact was a 13% increase in annual VAT revenue after the introduction of the withholding system in 2017

Revenue authorities in the Global South are constantly seeking new policy tools to improve domestic revenue mobilization through taxes. One

new policy adopted in several African countries is a withholding system for VAT, which reversed the responsibility of remitting the VAT of certain

transactions. In this brief, we investigate the impact of adopting a VAT withholding system on VAT collection in Zambia.

Zambia applies VAT at a standard rate of 16%. The VAT comprises approximately a third of all tax revenue in Zambia — with high annual variation. The VAT system in Zambia has been struggling with high claims of refunds relative to reported taxable sales and with late payments. The system is also characterized by high irregularity in VAT filing.

In 2017, Zambia introduced a withholding system for VAT through appointed withholding agents. Usually, VAT-liable firms collect and remit the VAT on their sales, but this tax enforcement tool assigned a number of large corporations and public entities to additionally withhold and remit the VAT on their input purchases on behalf of the supplier firms. The supplier firms would still be obliged to file their taxes.

In 2017, Zambia introduced a withholding system for VAT through appointed withholding agents. Usually, VAT-liable firms collect and remit the VAT on their sales, but this tax enforcement tool assigned a number of large corporations and public entities to additionally withhold and remit the VAT on their input purchases on behalf of the supplier firms. The supplier firms would still be obliged to file their taxes.

Strong and significant impact on revenue raised and taxes filed

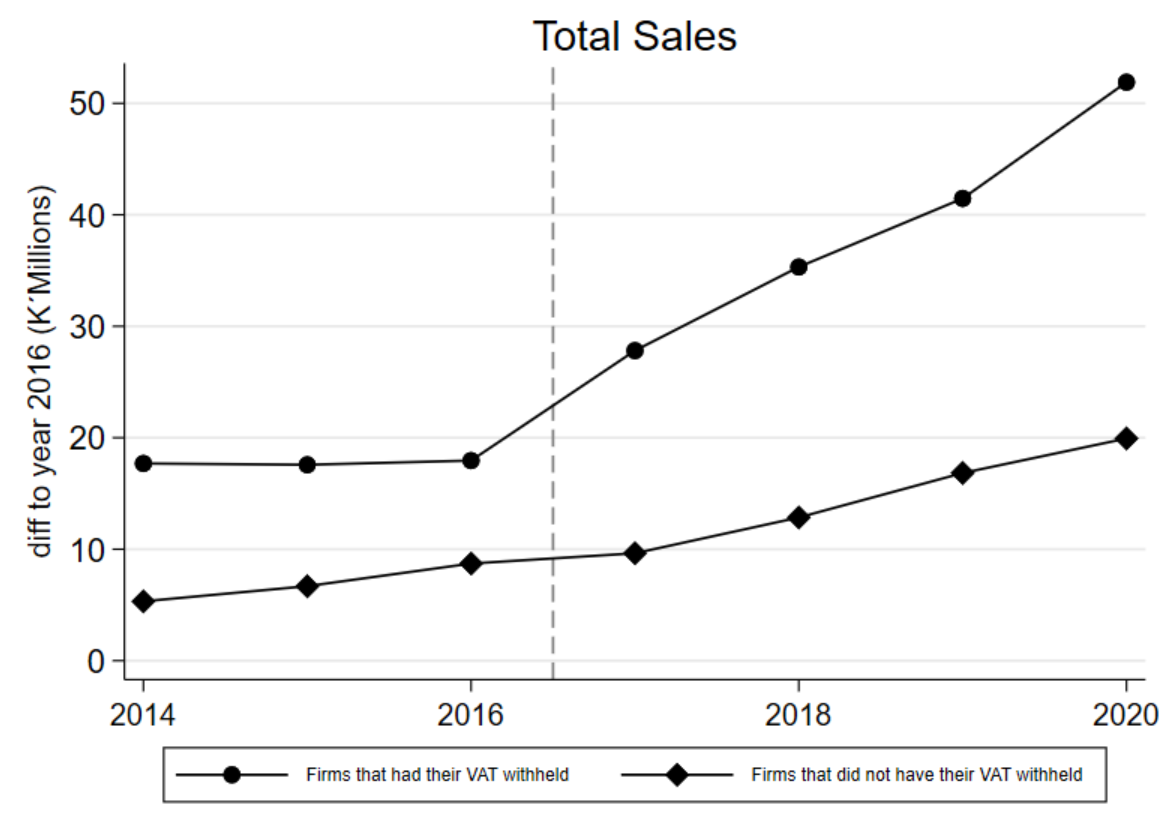

An analysis based on a difference-in-differences method was conducted using administrative data on VAT reporting from Zambia Revenue Authority. The method is grounded on the notion that before the reform, both firms that had their VAT withheld and those that did not evolved the same way, as shown in Figure 1 for reported total sales.

The results of the analysis show that at the firm level, the reform increased the reported sales and value added by approximately 10% among the firms that had some of their VAT withheld. Furthermore, the reform increased the likelihood of filing VAT return by 13% among those firms that filed at least once after the reform.

Figure 1: Development of firm-level sales of the firms that had their VAT withheld and of those that did not

The withholding system also had strong and significant impacts on the aggregate VAT revenue raised by the Zambia Revenue Authority (ZRA). Based on the firm-level effect, the aggregate VAT revenue was at least 13% higher compared to 2016.

It is worth noting, however, that the study results are limited to firms that filed VAT during the period. This is a caveat in the use of administrative tax data due to the fact that VAT under reporting and non-compliance is common among Zambian firms.

When implemented well, VAT withholding provides an efficient way to enforce revenue collection

As the VAT withholding incentivizes reporting VAT, such policies show to be successful in reducing VAT filing irregularity

Innovative withholding policies should be considered when seeking for new ways to raise revenue

The results suggest that the withholding mechanism was very successful in increasing VAT revenue and VAT filing. With a successful implementation of the VAT withholding policy, the system can have very positive impacts on VAT revenues. Even though calculating the administrative costs of the implementation of this reform in Zambia were out of the scope of this study, these positive revenue impacts were likely to exceed the administrative costs related to the system.

Join the network

Join the network