Blog

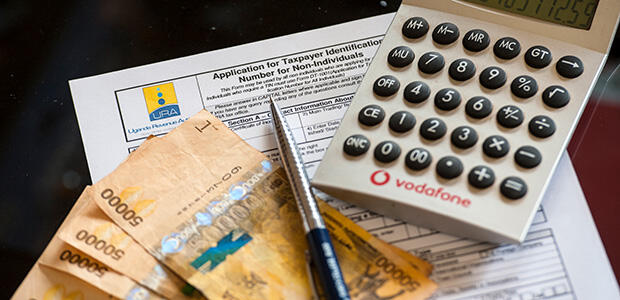

Uganda’s tax system isn’t bringing in enough revenue, but is targeting small business the answer?

Uganda, with a fiscal deficit of 5.6% in 2023, has increasingly turned to local resources to make up for its revenue shortfall since the World Bank...

Working Paper

Global minimum corporate income tax

This paper simulates the impact of the global minimum corporate tax rate (GMCTR) in Uganda by estimating the difference between the mechanical and the behavioural changes in tax revenue. Overall, implementation of GMCTR will increase tax revenue, and...

Working Paper

Did Uganda’s corporate tax incentives benefit the Ugandan economy or only the firms?

Uganda has one of the lowest corporate income tax collection rates in sub-Saharan Africa, while offering generous corporate tax incentives. It is unclear whether tax incentives achieve their objectives without primarily benefiting firms, potentially...

Working Paper

Global profit shifting, 1975–2019

This paper constructs time series of global profit shifting covering the 2015–19 period, during which major international efforts were implemented to curb profit shifting. We find that (i) multinational profits grew faster than global profits, (ii)...

Journal Article

The effects of corporate taxes on small firms

We study the impact of corporate taxes on firm-level investments and business activity by exploiting a 6 percentage-point reduction in the corporate tax rate in 2012–2014 in Finland. We use detailed administrative data and a difference-in-differences...

Working Paper

Fiscal consequences of corporate tax avoidance

Multinational corporations shift a large share of their foreign profits to tax havens and, due to this corporate tax avoidance, governments worldwide lose a portion of their tax revenues. In this paper we study the consequences of multinational tax...

Working Paper

The indirect costs of corporate tax avoidance exacerbate cross-country inequality

Corporate tax avoidance hampers domestic revenue mobilization and, with it, the development of lower- and middle-income countries. While a wide range of studies has shed light on the magnitude of profit shifting by multinational corporations, the...

Working Paper

Profit shifting by multinational corporations in Kenya

Illicit financial flows directly impact a country’s ability to raise, retain, and mobilize its own resources to finance sustainable development. Against a backdrop of a weak public financial position attributed to capital flight, tax avoidance, and...

Working Paper

Profit-shifting behaviour of emerging multinationals from India

This paper examines the profit-shifting behaviour of emerging multinational firms from India. It is found that the before-tax profitability of subsidiaries differs according to whether they were established directly or via an Offshore Financial...

Working Paper

Combatting debt bias in South African firms

The problem of debt bias can be tackled through either disincentivizing the use of debt financing or incentivizing the use of equity financing. Considering the South African context—in which many firms are highly leveraged and the marginal effective...

News

Press Release: New research reveals close to $1 trillion in profits shifted to tax havens

A new research paper published by the United Nations University World Institute for Development Economics Research (UNU-WIDER) shows the first global estimates of profits shifted to tax havens between 1975-2019. The study documents a remarkable increase in profit shifting, with close to $1 trillion or 40% of multinational profits shifted to tax havens in 2019. Globally, 10% of corporate tax revenues are lost as a result.

Join the network

Join the network