Blog

Inequality, fiscal space, and crisis response — A matter of priority, affordability, or both?

In response to the COVID-19 pandemic, governments financed more than 5000 fiscal support policies worldwide in 2020–21. The pandemic response is an example of how governments react to a major covariate shock —an often unforeseen shock with adverse effects on populations and major consequences for the general welfare of society.

Inequalities and the transitional governance of emergency

The pandemic provides a learning opportunity. Specifically, it highlights the importance of social protection policy to help households cope with economic shocks. The expansion of existing systems and the introduction of new social protection policies during the pandemic were enacted during a transitional phase. A phase of ‘transitional governance’ occurs via the declaration of a national disaster. Under these legal frameworks, governments can react swiftly to introduce measures for the general safety and welfare of the public.

In recent memory, there are only a few events comparable to the global pandemic in terms of their impact on national economies and the global economy alike —such as the global financial crisis in 2008— where many countries needed to respond simultaneously and rapidly. But the consequences of both the emergency and its response were unevenly distributed, which makes existing inequalities a central part of the story.

Often it is the people who were already most vulnerable, suffering from economic deprivation or inequalities, who were affected more severely. This shows that the conditions in society prior to a crisis matter, not only in shaping the type of challenges experienced by individuals, but also in the level and diversity of policy responses needed.

Crises response in low- versus high-income countries

My recently published study evaluates how existing levels of inequality and available fiscal capacity shaped the scale and diversity of the crisis response across countries. The study tries to answer whether the observed crisis response can serve as a feasible blueprint for similar future events.

Feasibility is explored through political and fiscal aspects, resting on the idea that the feasibility of government actions depends on the social contract between government and citizens. Fiscal feasibility in my study is explored by using a country’s ratio of crisis response spending to tax revenue (who pays). Fiscal feasibility is related to, but distinct from a country’s fiscal space. Political feasibility examines whether countries with higher levels of inequality implemented more diverse policy portfolios (who benefits). The terms fiscally and politically feasible refer to crisis responses that seem adequate.

My study uses the UNU-WIDER Government Revenue Dataset and the Covid Stimulus Tracker by UNESCWA, as well as the harmonized Gini coefficient —a standard measure of the overall inequality level— from the UNU-WIDER WIID Companion dataset.

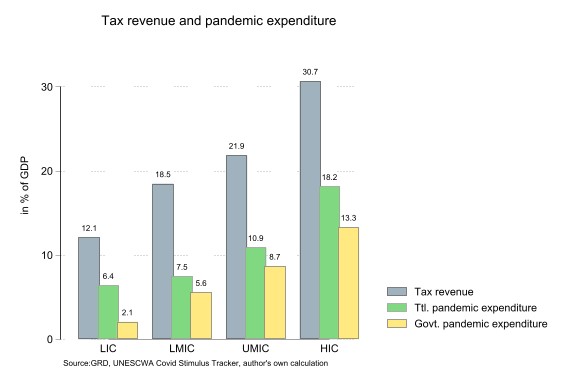

In the year prior to the pandemic, high-income countries collected broadly three times the tax revenue of low-income countries, collecting on average 31% of GDP compared to 12% of GDP. Similarly, high-income countries also spent three times as much on crisis relief compared to low-income countries (18% versus 6% of GDP).

Figure 1

When we exclude central bank liquidity support and aid, and only focus on the crisis relief financed by government fiscal support, the spending gap between low- and high-income countries widens even further with high-income countries spending more than six times low-income countries as a percentage of GDP (13% compared to 2%). The number of new policies implemented and supported by governments is also four-fold in high-income countries (on average 41 policies to 10 in low-income countries).

These figures broadly reflect global inequalities in the different capacities of countries to respond to a crisis.

Feasible blueprints?

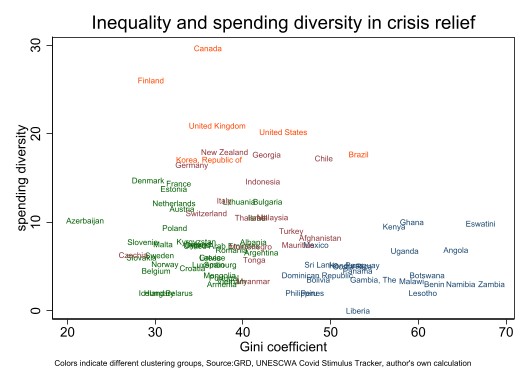

My study attempts to explore broadly whether spending diversity matches the level of inequality prior to the crisis. This is because it is reasonable to assume that more unequal societies will need a more diverse policy portfolio to meet the manifold challenges faced by households in societies with a more varied landscape of gaps and existing fault lines.

Figure 2

Source: Oppel, A. (2022). ‘Social Protection Expansions During Crisis And Fiscal Space: From Ad Hoc To Durable Solutions?’. WIDER Working Paper 2022/94. Helsinki: UNU-WIDER. See Appendix A.

When looking at countries based on their government spending, the size and diversity of their policy portfolio, and existing inequality levels, four country groupings emerge. In two country groups, the fiscal burden of pandemic expenditures is more manageable, only representing a moderate share of total tax revenues. These groups also demonstrate a closer alignment between inequality levels and more diverse policy portfolios.

The other two country groups demonstrate crisis responses that both strain fiscal resources and do not seem to address the diverse needs of households in unequal societies. I consider the countries in these groups to have implemented a response that is not a feasible blueprint for the future under current conditions.

Unfortunately, every low-income country I observed finds itself in one or the other of these two latter groupings —often because despite higher levels of inequality, there is lower spending diversity and scope overall. By contrast, four out of five high-income countries (81%) sit in the feasible groupings.

These findings should cause us to reflect on whether policy efforts can be made more sustainable, for example with adaptive social protection systems that can be expanded on an ad-hoc basis during a crisis. In formulating viable pathways to future resilience, these findings underscore the importance of jointly looking at domestic revenue potential and spending prioritization when formulating sustainable and inclusive social protection expansions.

As such, future resilience to crises depends critically on both greater equality between nations as well as how vulnerable to shocks a country is to begin with —which often depends on a mutual constitution between global and national inequality.

Annalena Oppel is a Fellow at the London School of Economics and Political Science

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network