News

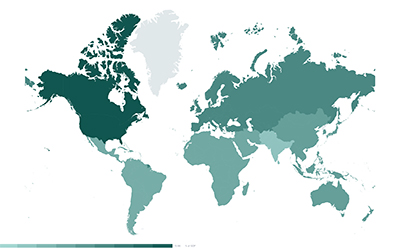

GRD 2023 update: Cross-country tax and revenue collection data for almost 200 countries

The GRD, which has been hosted by UNU-WIDER since 2016, continues to represent the most complete cross-country dataset on domestic revenue statistics. It incorporates data from sources such as OECD Revenue Statistics, the IMF Government Finance Statistics (GFS), and the IMF Country Reports.

The GRD Explorer tool allows users to access the updated GRD, compare countries, regions, and indicators, as well as to visualize the data. Alternatively, the dataset is available for download in Stata and Excel formats here. An updated User Guide and a Frequently asked questions section are released together with the data update.

The GRD Explorer tool allows users to access the updated GRD, compare countries, regions, and indicators, as well as to visualize the data. Alternatively, the dataset is available for download in Stata and Excel formats here. An updated User Guide and a Frequently asked questions section are released together with the data update.

The dataset is useful for the global research community in many ways. Some of the recent research findings taking advantage of GRD indicate that:

- Mobile money adoption significantly increases tax revenue in a sample of 104 countries. The impact is stronger on direct taxes compared to indirect taxes.

- Foreign direct investment (FDI) and financial sector development (measured by bank system’s depth) increase tax revenue in developing countries

- On average, tax capacity – the ratio of actual to potential tax revenue – is high in sub-Saharan Africa. Equity in government spending is the most important institutional factor contributing to greater tax capacity

About the GRD

The Government Revenue Dataset (GRD) contains data on government tax and non-tax revenues, social contributions, and grants in both local currency and as a percentage of GDP. It also highlights the portion of government revenues that accrue from natural resource extraction.

The dataset is updated annually based on changes or updates to the underlying data, as well as on feedback from users.

The GRD is part of UNU-WIDER’s Domestic Revenue Mobilization (DRM) programme, which is supported by the Norwegian Agency for Development Cooperation (Norad).

Join the network

Join the network