Background Note

Expanding a wage subsidy during lockdown

Introduction

The South African youth wage subsidy started in 2014 to increase employment and create jobs for low-wage youth. The subsidy was temporarily raised in value and expanded to reach more workers due to the COVID-19 pandemic. During the lockdown period, the government used the subsidy to curb unemployment and, in turn, social fallout.

Employment subsidies have been used worldwide to create jobs when employment prospects of a particular group are low. During a pandemic, this same policy tool can be used to help firms retain workers. In the wake of the 2008 economic crisis, a wage subsidy was introduced in Mexico to encourage manufacturing firms to retain workers. Firms that retained workers were granted subsidies instead of letting workers go during the crisis. The evidence suggests that wage subsidies reduce job destruction in manufacturing industries.

In many countries, subsidies are considered necessary to support workers’ income and firms’ survival, particularly when a lockdown policy limits business activity. In the COVID-19 crisis, several countries implemented wage subsidy programmes to save jobs.

Wage subsidy policies represent almost a third of all the labour market policies considered during the pandemic. In a living paper, experts provide a global overview of the wage subsidy programmes and policies being implemented in response to the pandemic. The May 2021 version of the living paper counts 120 countries with some form of subsidy programme.

Implementation rates between low-income countries (LIC) and high-income countries (HIC) differ and are generally lower in LICs. LICs typically have lower proportions of formal wage workers, lower institutional capacity, and limited fiscal capacity. Additionally, wage subsidy policy implementation varies across countries; some allow firms to reduce work time while others prohibit firms from firing workers. The wage subsidy amount also varies across countries —either fixed, regardless of the firm sector or losses in firms’ sales or profits, or proportional and dependent on the economic damage firms suffered.

This note outlines the structure of the original Employment Tax Incentive (ETI) in South Africa, presents some statistics from previous policy years, puts some numbers to the COVID ETI implemented due to the pandemic, and suggests avenues for further research.

A job-creating policy

South Africa has phenomenally high levels of youth unemployment. The youth unemployment rate has been above 40 per cent in the post-apartheid period, but has remained closer to the 50 per cent mark in recent years. The wage subsidy policy was designed to stop unemployment from increasing and bring unemployment rates down for youth.

An important design feature of the wage subsidy programme in South Africa is that it is not automatically applied to employers of eligible workers. Firms need to follow administrative steps through the tax system to claim the subsidy. The subsidy value is subtracted from the payroll tax that a firm owes to the South African Revenue Service (SARS). In other words, the ETI is structured as a tax credit for eligible businesses.

The first subsidy phase: 1 January 2014 – 28 February 2019

The first subsidy phase includes the initial phase plus the first policy renewal, where there were no material changes. Firms and firm employees must meet some criteria for claims to be eligible. Firms need to be registered for payroll taxes (Pay As You Earn – PAYE) and could be disqualified if found to have displaced an older employee to hire a young (eligible) person to claim the subsidy. Firms could claim this subsidy if employees are between 18–29 years old, hired after 1 October 2013, earning less than ZAR6,000, and are South African citizens. No requirements were set on the period of unemployment before employment of eligible employees, as is sometimes seen in similar policies in other countries.

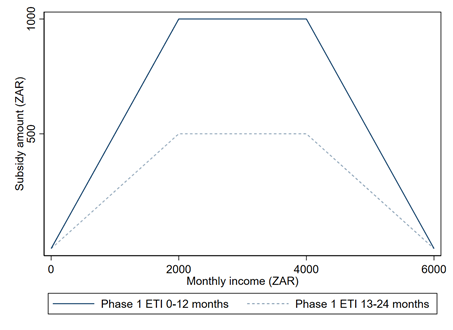

Firms claim the subsidy for 24 months for an eligible employee; however, the subsidy amount is reduced after 12 months. Firms can claim the subsidy for as many eligible employees as they have. The subsidy amount follows a sliding scale, as shown in Figure 1.

In the first subsidy phase (denoted Phase 1 in Figure 1), for the first 12 months of the claims, the subsidy rate is 50 per cent of monthly income for a salary of ZAR0–2,000. Between ZAR2,000 and ZAR4,000 (the plateau region), the subsidy is a constant ZAR1,000. For wages above ZAR4,000, the subsidy amount decreases with monthly income and ceases for incomes above ZAR6,000.

The value of the subsidy is halved in the second 12-month period of employment. Namely, between ZAR0 and ZAR2,000, the subsidy rate is 25 per cent of monthly income. Between ZAR2,000 and ZAR4,000, the subsidy is a constant ZAR500. And between ZAR4,000 and ZAR6,000, the amount of the subsidy again decreases with monthly income.

Figure 1: Phase 1 subsidy value against monthly income

Source: authors’ illustration based on information from the Employment Tax Incentive Act.

There is a small, growing literature on the first phase of the subsidy period,1 some of which indicates youth employment creation at small and medium-sized firms, particularly in the financial and business services, manufacturing, and wholesale and retail sectors (National Treasury 2016; Ebrahim et al. 2017; Bhorat et al. 2020). One piece of research even suggests the policy is linked to a decline in job losses for eligible workers, which points to job retention. However, the overall result is that the policy has not changed the trajectory of youth unemployment rates. Despite this limited performance, the policy was renewed in 2018 for ten years.

The second subsidy phase: 1 March 2019 – current

The main change to the subsidy in the second phase was the wage eligibility criteria. The wage eligibility criteria were increased from ZAR6,000 to ZAR6,500 per month, which also changed the subsidy calculation. For example, in the first phase, firms were able to claim a subsidy of ZAR755 for an employee earning ZAR4,450 per month; in phase 2, firms can claim a subsidy of ZAR1,000 for an employee earning ZAR4,450. The motivation for this change is related to inflation.

The second change was removing the age criteria in special economic zones (SEZ) to increase the number of eligible workers in these areas. The second subsidy phase has not yet been studied due to a lag in available tax administrative microdata to conduct analysis. It is, therefore, unclear whether there has been any job creation in the second phase.

COVID-19 Tax Relief through ETI

The COVID-19 Tax Relief through ETI (henceforth covid ETI) was part of a package of tax relief measures implemented by the government to support businesses through the most restrictive lockdown period. The ETI was expanded for four months, from April through July 2020 and from August through November 2021. The expansion included an increase in the value of the subsidy and relaxation of the eligibility criteria for claims.

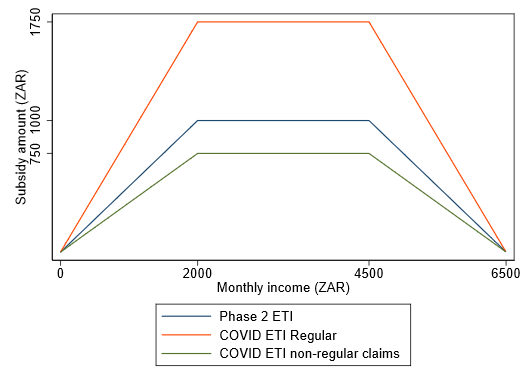

Where the regular ETI was in place, the covid ETI supplemented the subsidy value by ZAR750. The subsidy followed a different value schedule for those not regularly eligible for the ETI. The covid ETI follows the same design as the original policy – the subsidy’s value decreases with monthly income, with two kink points in the subsidy claim schedule.

The covid ETI is determined according to Table 1. For regular ETI eligible employees, the subsidy follows the schedule defined in the subsidy second phase (1 March 2019 onwards) with a top-up on the amount firms can claim. The subsidy rate is raised from 50 per cent to 87.5 per cent for eligible employees earning less than ZAR1,999. For eligible employees earning between ZAR2,000 and ZAR4,499, the subsidy is a constant amount equal to ZAR1,750. The subsidy amount decreases with monthly income for eligible employees earning above ZAR4,500. The value of the covid ETI subsidy is halved for those regular ETI eligible claimers in the next 12 months of the claim period.

A non-regular category of eligibility was included in the covid ETI (column 3 in Table 1). This new category had practically all other employees earning less than ZAR6,500: employees aged between 30–65 years, employees for whom firms previously exhausted ETI claims, as well as those employed before 1 October 2013 (aged between 18–29 years, regardless of age for employees within an SEZ). The highest subsidy rate for the non-regular group was 37.5 per cent of monthly income.

Table 1: COVID ETI values

| First 12 months | Next 12 months | After 24 months or age 30-65 | |

|---|---|---|---|

| ZAR0–1,999 | 87.5% of monthly income | 62.5% of monthly income | 37.5% of monthly income |

| ZAR2,000–4,499 | R1,750 | R1,250 | R750 |

| ZAR4,500–6,499 | R1,750-0.875x (monthly income-4500) | R1,250-0.625x (monthly income-4500) | R750-0.375x (monthly income-4500) |

Note: the table shows the subsidy value as determined by monthly income. Columns 1 and 2 correspond to the figures for the first and second 12 month claim period for those between 18 and 29. Column 3 includes the subsidy values for the non-regular group with monthly income.

Source: authors’ computation based on Disaster Management Tax Relief Act.

The phase 2 subsidy values are compared to the covid ETI subsidy values in Figure 2. The covid ETI provides substantial relief to firms for regular ETI claimants and some financial relief for employees not regularly eligible for the ETI.

Figure 2: Subsidy value comparison between COVID ETI and Phase 2

Source: authors’ estimates based on information from the Employment Tax Incentive Act and Disaster Management Tax Relief Act.

South Africa had an existing wage subsidy policy before the pandemic providing the country with a policy tool to reduce the effects of the pandemic on the labour market through firms. This is in contrast to LICs, where wage subsidy programmes are not typically implemented due to fiscal constraints and limited evidence of the success of such programmes.

Areas for policy-relevant research

The implementation of the covid ETI presents an opportunity to examine the impact of novel changes to the wage subsidy. The most interesting outcome is to prove whether a wage subsidy expansion is a suitable instrument to mitigate unemployment during macroeconomic crises. This evidence would provide much-needed proof of options should the government encounter another crisis.

An oft-cited query on the ETI is its effectiveness on a macro scale since youth unemployment remains as bad as ever. This has been the main topic of ETI research and continues to be an essential question to answer. Below, we share specific policy-relevant research areas stemming from the regular scheme ETI and covid ETI:

- Assess the impact of the covid ETI on job destruction relative to the pre-pandemic wage subsidy scheme.

- Assess the impact of different amounts of wage subsidy (that is, the subsidy as a fixed-amount transfer versus a proportional amount of income losses) on job retention.

- Simulate and assess a varied period for a regular scheme ETI to see if the 2-year timeframe of the regular scheme ETI is yet an optimal length

- Assess the impacts of covid ETI in different districts or regions in South Africa to see which parts are particularly vulnerable to economic shocks and provide guidance on how future emergency relief-based ETIs should be targeted.

- Provide evidence of the firm type and size impacts to demonstrate possible subsidy targeting during and outside an economic crisis.

- Isolate the wage effects of the ETI as an ‘employment subsidy’ versus a strict ‘wage subsidy’.

- Calculate the elasticity of labour demand and supply for young workers to inform policy considerations such as an amendment or expansion of the policy, either via a higher subsidy or whether it should be extended to all ages.

- Provide evidence for ways to improve the subsidy’s effectiveness and efficiency.

- Contrast and compare the ETI’s impact against other flagship public sector COVID-19 employment relief measures such as the Temporary Employer/Employee Relief Scheme. Evidence that employers preferred additional support over the ETI may illuminate the potential reasons (for example, administrative burden) for low ETI take up and impact.

Through the efforts of the National Treasury Secure Data Facility, the latest payroll tax data will become available in 2022, covering the first period of the covid ETI. The data includes three years of pre-policy and six years post-reform, providing a substantial panel to examine the ETI and its impacts. The tax data offers the opportunity to explore many of the areas of research listed above, particularly if complemented by data from other COVID-19 relief initiatives.

Research in these and potentially other areas will add to the expanding literature on the policy in South Africa and, more broadly, for other developing countries. Further research will increase policy-makers’ evidence base when implementing and improving policies related to youth and employment in South Africa.

Join the network

Join the network