Blog

Are Sovereign Wealth Funds fit for purpose in Africa?

Sovereign Wealth Funds (SWFs) have become a symbol of national success and a means for global, commercial and geopolitical influence. But how well do they contribute to national development goals? Furthermore, global decarbonization threatens the future of many fossil fuel-financed SWFs. Here, we report research evidence to assess the state of SWFs in Africa and how to maximise their impact.

Sovereign Wealth Funds (SWFs)are at the core of considerable policy and academic debate. Once heralded as a powerful vehicle for governments to direct revenues from natural resources such as oil and gas towards development, their purpose is increasingly blurry. This is especially the case in an era marked by climate change. While several studies have explored their strengths and weaknesses, there is surprisingly little evidence regarding their economic impact.

SWFs are state-owned pools of money held by the central bank. Governments invest this money to raise funds that pay for public services, economic development and financial support for citizens. Much of the money in SWFs comes from taxes, royalties, dividends and licences from oil and gas, and to a lesser extent, licences from mining.

Their numbers have rapidly grown since 2000. Over 100 SWFs worldwide now collectively hold USD 8 trillion in assets. However, Africa holds less than 1% of the world’s total in terms of asset value. Further, the capital held by Africa’s SWFs has shrunk by two-thirds since the commodity price boom ended in the 2000s and in response to subsequent shocks, notably the COVID-19 pandemic, as governments tried to maintain their spending.

There are therefore reasons to question their developmental impact which we explore here.

SWFs have three different objectives:

- Stabilization: They can provide a source of money for public expenditure if the economy takes a sudden dip, thereby creating more predictability for government spending over time.

- Intergenerational savings: They transfer wealth across generations – money raised today can be saved for citizens who need it in future.

- Domestic development: They fund infrastructure, development projects and domestic businesses to support economic growth.

The standard policy advice has been to limit SWFs to a stabilization mandate without investing domestically. However, one study argues SWFs should target domestic investment to help economic development. Another suggests they should target export diversification objectives through a mix of domestic and foreign investments.

So what is the best use of SWFs, and especially in the face of climate change? We next consider the evidence for the African continent, drawing on our work for the United Nations University World Institute for Development Economics Research.

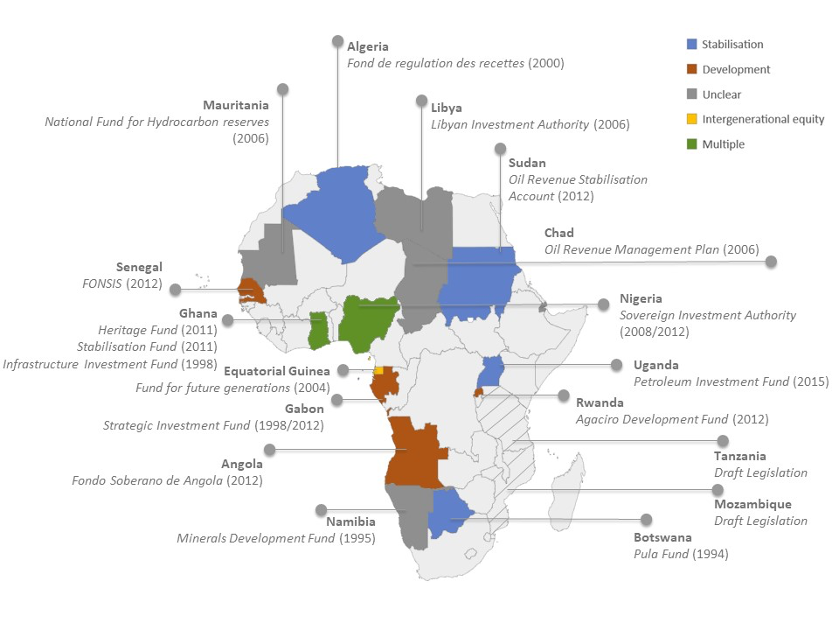

Figure 1: Mapping the objectives of SWFs in Africa

SWFs for stabilization

Stabilization funds are often necessary, but they have limitations and often come at the expense of achieving other developmental objectives. Furthermore, the pandemic has taught us that while stabilization-oriented SWFs can help weather the crisis, many low and middle-income countries are highly unlikely to have a fund of sufficient scale to protect against shocks as big as the pandemic.

So how to build resilience not just for rainy days, but also stormy seasons? Lower-income countries need a robust international monetary system that offers comprehensive assistance during tough times. Without such a system, countries often resort to self-insurance by building up their own (and often too small) fiscal stabilization funds. In many instances, paying off national debts with unexpected windfalls of revenue might be a smarter move (than capitalizing SWFs) to improve borrowing capacity in times of need, especially when global financial support systems are lacking.

Transferring wealth across generations

Citizens may want to transfer wealth to their future selves to fund a comfortable old age, or to future generations for financial security. Nevertheless, there is a case against intergenerational SWFs.

First, citizens with unmet basic needs may well prefer more spending today on child nutrition, basic healthcare, education and cash-transfers to benefit everyone. Many Africans never reach adulthood, let alone old age. The infant mortality rate for Africa is shocking: one out of every 13 children in sub-Saharan Africa dies before their fifth birthday. Of the 20 countries with the world’s highest infant mortality rates, 19 are in Africa. Further, while investing wealth in financial assets transfers wealth across generations, investments in real assets, such as education or healthcare, supports the wellbeing of both current and future generations.

SWFs and the climate challenge

Climate change threatens the future prosperity of intergenerational SWFs. All financial assets are at risk if global temperatures go beyond 1.5 degrees Celsius above pre-industrial levels, with accelerating damage at increases above 2 degrees Celsius.

The potential of SWFs in Africa is even more relevant in the context of the climate crisis, which should influence how governments spend public savings. Climate stress jeopardizes agricultural productivity on the continent, strengthening the case for moving away from fossil fuels. But global decarbonization efforts may also hurt African economies. Carbon-based fuels represent around 40% of African exports—with countries such as Algeria, Angola, Chad, Nigeria and Sudan highly dependent on them (including to fund their SWFs).

Indeed, of the world’s 20 biggest SWFs, 12 originate in savings from oil and gas revenues, including the Libyan Investment Authority (LIA), Africa’s largest SWF and the only African SWF in the global top 20. Africa’s next largest SWF is Botswana’s Pula fund, originating in diamond revenues. Petroleum-based economies—Algeria, Angola, Equatorial Guinea, Ghana, Nigeria and Uganda—constitute most of the region’s remaining SWFs.

Global decarbonization, therefore, also imperils many of Africa’s SWFs. This is why tackling climate change and building SWF resilience go hand in hand. A recent survey indicated that 60% of SWFs believe that accounting for climate change will improve their long-term returns.

SWFs vs dedicated development funds

It is crucial that we improve our understanding of the trade-offs between SWFs and sovereign development funds (SDFs) or national development banks to promote a climate-resilient transformation of Africa’s economies.

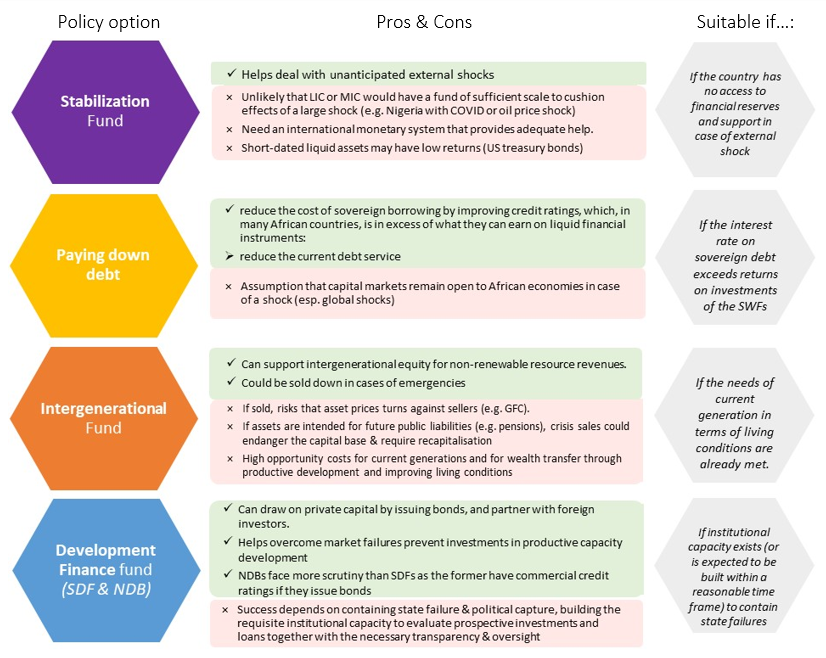

Figure 3: Pros and cons of different resource revenue management options

Our research suggests that national development banks offer greater potential than SWFs for stimulating this long-term transformation. However, this is provided that the banks have clear mandates, strong governance, legislative oversight and—not least—proper investment analysis, monitoring and evaluation.

Although starting new development funds, or recapitalizing existing ones, is beneficial, they are no substitute for current public investment. Clear fiscal rules that shape how governments invest are necessary.

However, it is often difficult for governments to pursue a consistent strategy for spending public savings, even with rules in place. SWFs that begin as intergenerational funds often turn into de facto stabilization funds when hard-pressed governments need to maintain spending.

Overall, the standard policy advice when it comes to SWFs may not be suitable for Africa, whose countries are marked by pressing needs for economic diversification and climate resilience.

To rethink the role of SWFs, African countries will need much greater concessional (more affordable) and grant funding from the international monetary system to deal with economic shocks, like climate change. The research we discuss here indicates that international finance institutions and multilateral institutions must take bolder steps towards prioritizing sufficient development finance for future prosperity and climate resilience.

Tony Addison is a Professor of Economics at the University of Copenhagen in the Development Economics Research Group, and a Non-Resident Senior Research Fellow at UNU-WIDER in Helsinki, Finland.

Amir Lebdioui is an Associate Professor of the Political Economy of Development at the University of Oxford.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network