Background Note

COVID-19 and employment

Insights from the sub-Saharan African experience

Introduction

The COVID-19 pandemic poses important risks for people’s health and economic wellbeing. While the full socio-economic consequences remain uncertain, the pandemic’s impact on the labour market has become an issue of global concern. Especially low-income earners with jobs in precarious, informal sectors of the economy, without unemployment insurance, limited access to healthcare, and no back-up savings, are most at risk. Already disadvantaged groups will suffer disproportionately from the adverse effects of the pandemic.

Policy makers in the Global South have responded with a range of measures, varying from cash transfers for the poor to loans for small enterprise. In this note, we summarize some of the impacts of COVID-19 on employment and livelihoods, and detail the policy responses of developing countries, drawing from the sub-Saharan African experience. We first provide an overview of the progress of the pandemic in sub-Saharan Africa (SSA), and the mitigation and suppression measures taken by SSA governments. We then discuss what we know so far on the employment effect of the pandemic in SSA. Finally, we discuss policy responses to the pandemic, focusing on the experience of one SSA country—Ghana.

How have countries in sub-Saharan Africa responded to the COVID-19 pandemic?

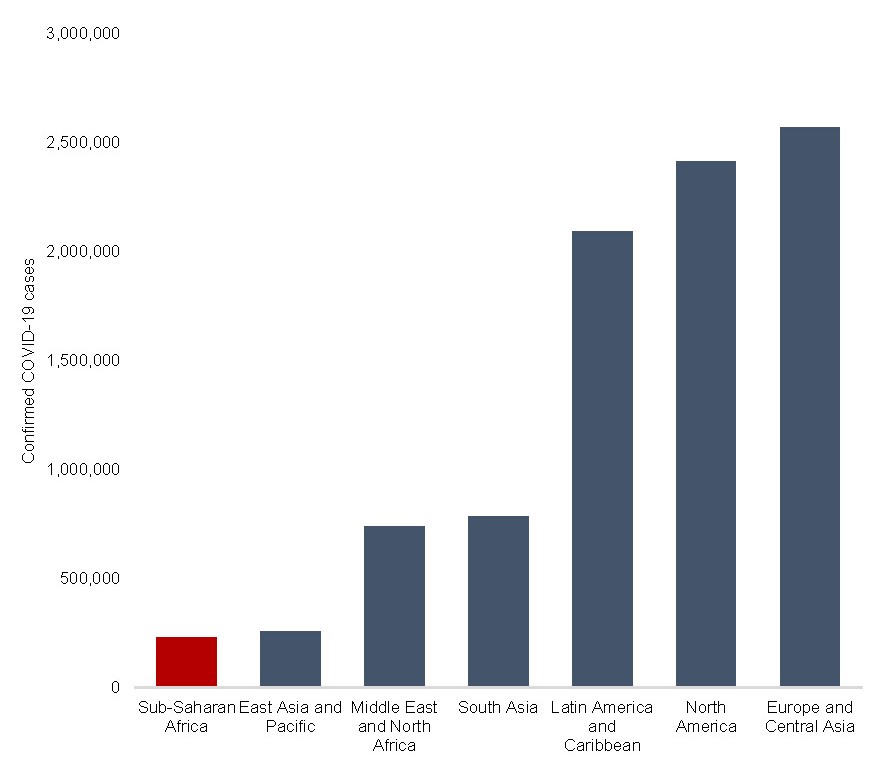

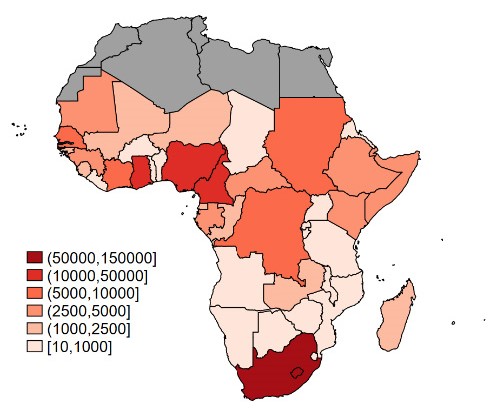

As of 22 June 2020, according to data from the Johns Hopkins University (JHU), over 9 million COVID-19 cases have been confirmed worldwide (see Figure 1). SSA registered 230,116 cases, concentrated particularly in South Africa (101,590), followed by Nigeria (20,919), Ghana (14,154), and Cameroon (12,041). Around half of SSA countries had under 1,000 confirmed cases (see Figure 2).

Figure 1: Confirmed COVID-19 cases, ranking by world region, 22 June 2020

Figure 2: Confirmed COVID-19 cases in sub-Saharan Africa, 22 June 2020

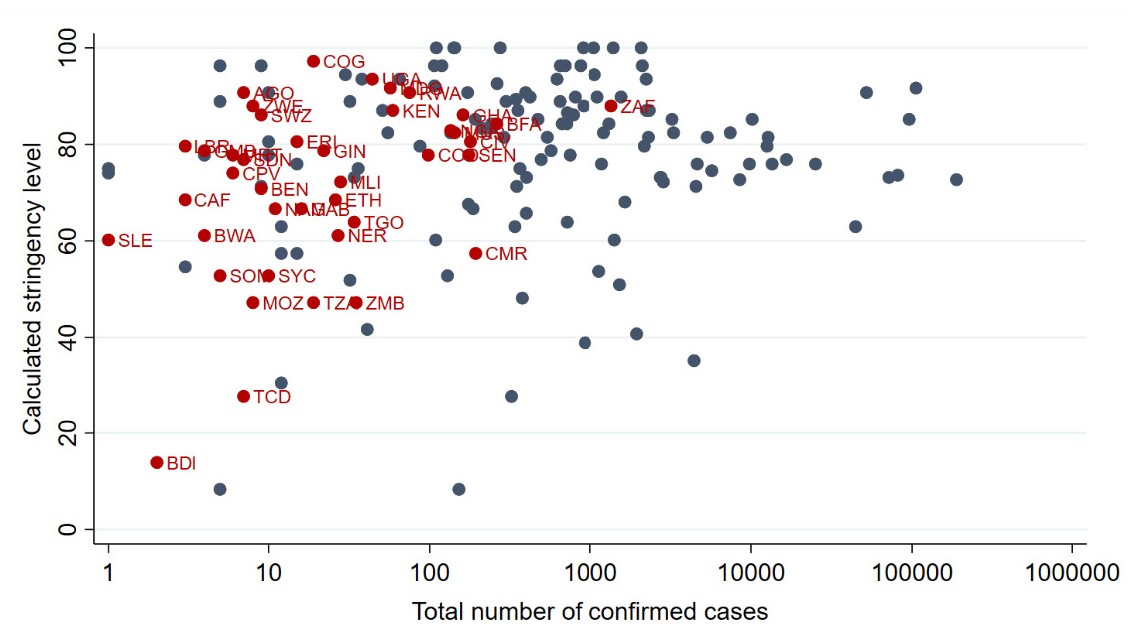

In face of weak and already overwhelmed health systems, most countries across SSA responded early with stringent measures to contain the spread of the virus (see Figure 3). As of 31 March 2020, according to the Oxford COVID-19 Government Response Tracker (OxCGRT), out of 44 SSA countries, 95 per cent had closed schools for all education levels, 66 per cent had required workplace closures (or work from home) for at least some sectors or categories of workers, 32 per cent had closed public transport (or prohibited most citizens from using it), and 43 per cent had adopted curfew or lockdown policies (requiring people to stay home with varying exceptions).

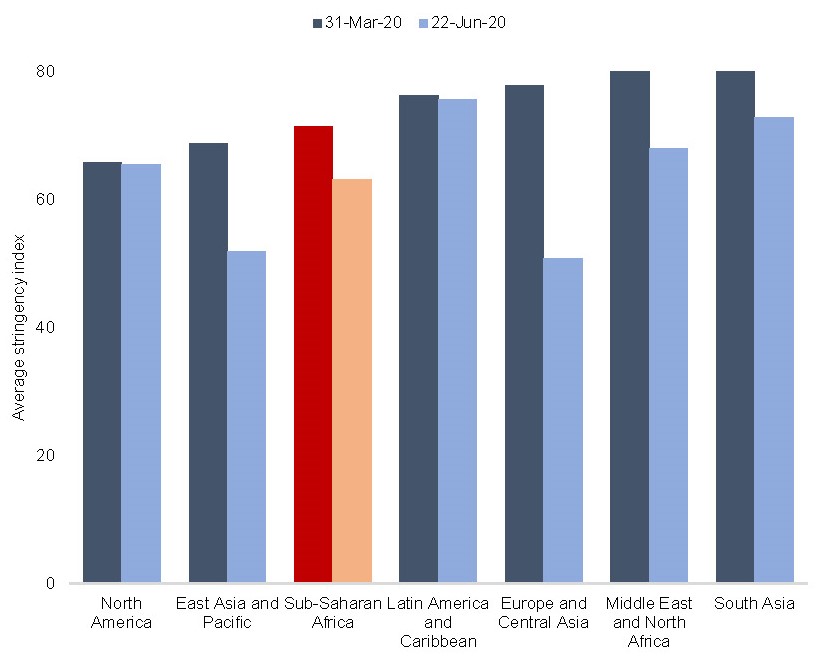

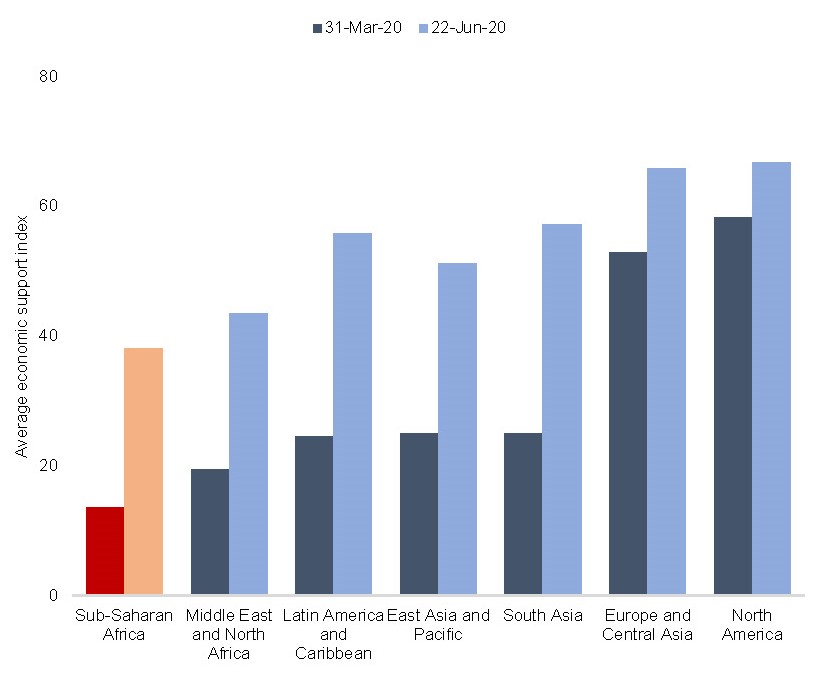

Globally, governments began to gradually relax confinement measures from May 2020 onward (see Figure 4). At the same time, economic support measures—mainly in form of direct income support—have been scaled up. As of 22 June 2020, half of the countries in SSA provided some type of income support to workers as a temporary relief measure, of which the majority also included transfers to informal sector workers. However, countries in SSA lag behind other world regions in terms of economic support provided (see Figure 5), and while the measures present an important step in the right direction, the effective provision—in the majority of countries replacing less than 50 per cent of lost salary—may not suffice to provide significant relief and secure the livelihoods of the most vulnerable people in the region (Bassier et al. 2020).

Figure 3: Stringency of COVID-19 government responses, 31 March 2020

Figure 4: Stringency of COVID-19 government responses, ranking by world region

Figure 5: COVID-19 government economic support measures, ranking by world region

How has COVID-19 affected employment in sub-Saharan Africa?

The outbreak of the COVID-19 pandemic has caused a major disruption to economic activity across the world, including SSA. The World Bank projects that economic growth across the region will decline from 2.4 per cent in 2019 to -2.1 to -5.1 per cent in 2020. This outcome would be the first recession that SSA has seen in 25 years, with major impacts on poverty and food insecurity. A global drop in commodity prices and demand from the main trading partners—including China, India, the United States, and several European countries—alongside stringent government response measures, is likely to have a devastating impact on the incomes of workers and their dependents.

Workplace and market closures, restrictions on mobility, the suspension of some activities, and the associated reduction in demand for goods and services have already resulted in a slowdown in production and caused a reduction in working hours and labour earnings. This especially affects workers in the large informal sector, accounting for 80 per cent of all non-agricultural employment in the region.

Accordingly, a recent rapid survey of businesses in Uganda suggests that lockdown measures have reduced business activity by more than half, and finds that micro and small enterprises experienced a larger decline in activity compared to medium and large enterprises. Similarly, real-time survey data collected in Senegal, Mali, and Burkina Faso suggests that on average, by the end of April, one out of four workers had lost their jobs, and one out of two workers had experienced a decline in earnings. The findings furthermore indicate that informal workers are at higher risk, as they generally rely on daily sales for their earnings, lack mechanisms for collective bargaining, and tend to be in activities that are contact intensive and thus particularly affected by the pandemic response measures—such as restaurants, tourism, small retail shops, hairdressers, and taxi drivers.

These labour market effects are likely to persist even when curfew and lockdown policies have been lifted, for example if customers continue to avoid crowded markets, and if the economic downturn has lasting consequences for household spending. Moreover, given the nature of their work, many informal employees will remain particularly vulnerable to contracting the virus, once resuming their activities. Many of the most vulnerable are thus facing an explicit tradeoff between their health and their financial survival. In addition, the pandemic response measures may also aggravate gender inequalities in employment. Not only are the smallest and most vulnerable businesses often run by women, but women will also be disproportionally affected by school and day care closures, and often exit the labour market to care for children or sick relatives.

Policy response to COVID-19: the case of Ghana1

When the first two cases of COVID-19 were reported in Ghana on 12 March 2020, the country took steps to ban all public gatherings, close all schools and universities, and secure the country’s borders. A partial lockdown was subsequently introduced on 30 March in areas identified as ‘hotspots’. This was lifted on 19 April 2020. The country’s capacity to trace, test, isolate and quarantine, and treat victims of the disease was cited as one of the reasons for the decision. Nonetheless, the number of confirmed COVID-19 infections has been escalating. The update from the Ghana Health Service, as of 7 July 2020, indicates 21,968 confirmed positive cases and 129 deaths. There is therefore a need for the government to develop and deploy suitable and effective social influence strategies to persuade the population to wear face masks, wash hands and use hand sanitizers, and practice social distancing.

What supporting measures did the Ghanaian government take to protect the poor and vulnerable?

The government of Ghana rolled out the Coronavirus Alleviation Programme (CAP) to address the disruption in economic activities, the hardship of the people, and to rescue and revitalize industries. Some of these measures included:

- an extension of the tax filing date from April to June;

- a 2 per cent reduction of interest rates by banks, effective 1 April 2020;

- the granting by the banks of a six-month moratorium of principal repayments to entities in the airline and hospitality industries, i.e. hotels, restaurants, car rentals, food vendors, taxis, and uber operators;

- mobile money users can send up to GH¢100 for free; and a 100–300 per cent increase in daily transaction limits for mobile money transactions;

- the establishment of a COVID-19 fund, to be managed by an independent board of trustees and to receive contributions and donations from the public, to assist in the welfare of the needy and the vulnerable;

- a three-month tax holiday for health workers at the beginning of April 2020 and an amount of GH¢80 million to pay a special allowance for frontline health workers;

- fumigation of public places, including markets and schools;

- a directive to the ministries of gender, children and social protection, local government and rural development, and the National Disaster Management Organization (NADMO), working with Metropolitan, Municipal District Chief Executives (MMDCEs) and faith-based organizations, to provide food for up to 400,000 individuals and homes in the affected areas of the restrictions;

- a doubling of payments to the beneficiaries of the Livelihood Empowerment against Poverty (LEAP) programme;

- government will absorb the water bills for all Ghanaians for the three months of April, May, and June;

- government will also fully absorb electricity bills for the poorest of the poor, defined as lifeline consumers who consume zero to 50 kilowatt hours a month for this period. For all other consumers, residential and commercial, government will also absorb half of the cost of electricity bills for this period;

- a 1.5 per cent decrease in the policy rate and a 2 per cent decrease in the reserve requirement by the Bank of Ghana to help improve credit to businesses. Commercial banks are to respond to these measures by the regulator and provide a GH¢3 billion facility to support industry—especially in the pharmaceutical, hospitality, service, and manufacturing sectors;

- implementation of the flagship CAP business support scheme. An amount of GH¢1.2 billion has been earmarked for the CAP business support scheme to be made available to households and businesses, particularly small and medium-scale enterprises (SMEs).

Among these measures, the flagship CAP business support scheme seems to be a major intervention mitigating the negative impact of COVID-19 on households and livelihoods and providing support to micro, small, and medium-scale businesses (MSMEs). Out of the GH¢1.2 billion earmarked for this Programme, GH¢600 million will be disbursed as soft loans to SMEs, with up to a one-year moratorium and a two-year repayment period. The rate of interest on this facility is 3 per cent. Additionally, selected participating banks will provide negotiated counterpart funding to the tune of GH¢400 million, making the facility worth, in all, GH¢1 billion for disbursement under this Business Support Scheme, with the entire scheme set to attract some 180,000 beneficiaries across the country.

The funds will be managed by the National Board for Small Scale Industries (NBSSI) and supervised by a loan committee. The NBSSI reports that 450,000 applicants, representing MSMEs, have registered for the fund, 66 per cent of the applicants are female, and 34 per cent are male. All applicants are required to register for a Tax Identification Number (TIN) with the Ghana Revenue Authority to enable them to access the COVID-19 Relief Fund. The beneficiary sectors include agribusinesses, manufacturing, water and sanitation, tourism and hospitality, education, food and beverages, technology, transportation, commerce and trade, healthcare and pharmaceuticals, and textiles and garments.

In order to revitalise economic activities and provide the needed support to households and livelihoods, the CAP business support scheme can target and support essential SMEs—SMEs that provide inputs and services to support other SMEs—and particularly the agricultural sector.

Conclusion

The policy measures taken by the government of Ghana to combat the adverse economic effects of the pandemic is representative of what other SSA governments have also done in responding to the economic crisis—a combination of cash and in kind transfers, tax breaks, and loans to small firms (see Addison et al. 2020, Ebrahim 2020, and Were 2020). A challenge faced by SSA governments is that informal workers, who constitute a large proportion of the workforce in the continent, are often outside the reach of the state, making it difficult to enact the furlough schemes that we have seen Western governments undertake.

Moreover, given the precarious state of public finances in SSA, more expansionary fiscal stimulus packages are difficult to implement. While the spread of COVID-19 in SSA has been more limited compared to other developing regions, so far, the overall effect of the pandemic on employment and livelihoods in the region, and whether the policy responses are enough to combat the adverse effects of the pandemic on the working poor, are uncertain.

Join the network

Join the network