Research Brief

Critical reflection on the formalization of firms in Mozambique

Despite global efforts to formalize enterprises, the majority still operate informally. Recent data from 2022 indicates that 8 out of 10 enterprises globally remain informal. Advocates for formalization policies at the ILO and OECD argue that it benefits firms, workers, and governments.

In Mozambique, micro enterprises (0–4 employees) gain little from formalizing, as it does not lead to easier access to credit, formal financial records, or business with formal enterprises. While SMEs benefit slightly more from formalization, the overall impact remains minimal

To truly benefit, firms need more than just formal status; they must also meet other economic and social criteria, such as having a financial history or large social network, which many firms cannot

Formalization is unlikely to generate substantial government revenue because many MSMEs are tax exempt or earn little income

Priority should be on innovative support packages for MSMEs and improved public services

However, recent research in Mozambique reveals limited benefits for firms and suggests less urgency in formalizing all informal enterprises, advocating instead for comprehensive support for both informal and formal micro, small and medium enterprises (MSMEs) through packages that combine access to credit and business training. Evidence from qualitative interviews with informal business owners in Mozambique indicate that government policies to support formalization should be accompanied by measures to improve public service delivery in the one-stop shops (BAÚ), the Tax Authority, and the Institute for the Promotion of Small and Medium Enterprises (IPEME).

What is formalization?

Formalization typically involves businesses and their employees registering with government agencies. In many countries, this creates a continuum of formality, as businesses might register some authorities but not others, rather than a simple binary distinction between informal and formal status.

In Mozambique, informality dominates. 90% of enterprises and 80% of the labour force operate informally, contributing 38% to GDP. A report on a survey of MSMEs in the manufacturing sector conducted by the IGM programme shows that roughly half of these MSMEs lack any state registration. About 35% are registered with a municipality but lack national tax registration, while 11% have tax registration, but skip social security contributions for workers. This highlights formality as a spectrum from complete informality to full compliance with all regulatory requirements, including worker benefits.

The costs and benefits of formalization for firms

Firms choose formality when benefits like legal rights, access to credit, and the ability to sell to formal entities outweigh costs like fees and tax liabilities. In the informal economy, however, not all firms can afford formalization initially, even if it becomes profitable later. Not all firms can freely weigh the costs and benefits of formalization, as accessing benefits often depends on additional factors, such as financial history and literacy skills.

Research across various countries indicates that formalization’s impact is less positive than expected. A meta-analysis of 22 studies found only modest benefits, with over half showing no statistically significant impacts.

A recent study on the costs and benefits of formalization for Mozambican manufacturing enterprises is in line with this result, showing that the benefits of formalization, such as increased access to credit and number of customers, do not materialize among micro enterprises (employing less than five workers). Only SMEs with over four workers tend to reap benefits from formalization, albeit marginally: access to credit increased by 9 percentage points and number of customers by 13 percentage points after formalization. Further, another study on the same enterprises reveals that the association between formality and firm performance is not causal: while more formal firms have higher revenue, value added, and labour productivity, the relationship is statistically insignificant—better performance is driven by underlying firm characteristics, not by formalization per se.

Given these insights, policymakers should craft distinct strategies for micro enterprises and SMEs, recognizing that formality alone is not enough. Enhancements might include linking formalization with additional services, such as financial literacy programmes shown in Malawi to increase financial service use and profitability.

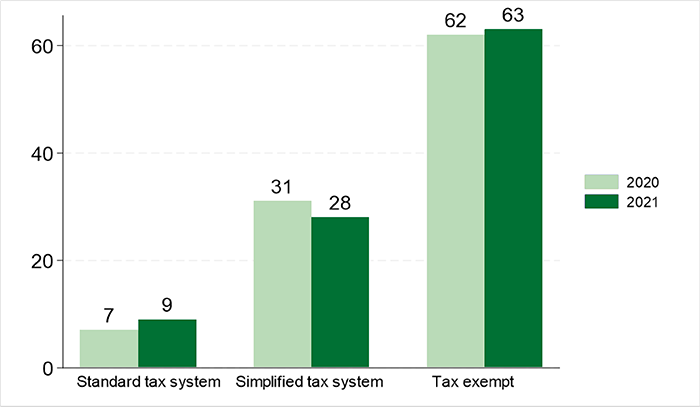

Figure 1 | Firms’ eligibility for tax systems in Mozambique

Source | IIM 2022 data. We calculated she share of firms that qualify for the different tax systems based on their turnover.

Additionally, only 11% of Mozambican manufacturing MSMEs have bank loans, indicating that formalization does not typically lead to improved credit access. To truly benefit these firms, credit conditions must be more favorable, and other formalization perks, like improved business opportunities and public services, need enhancement.

The costs and benefits of formalization for government

Registering enterprises involves not only costs for a firm but also for the state. In Benin, the expense of formalizing firms exceeds the additional tax revenue firms would pay in an entire decade.

Facilitate credit access through relaxed bank lending criteria

Tailor business training programmes to contextual needs, balancing soft and hard skills

Foster linkages between national and international firms

Improve public service quality, especially at one-stop shops (BAÚ), the Tax Authority, and IPEME

Ensure better enforcement of business regulations to support formal and informal enterprises

Effectively use scientific evidence from other African countries to create successful business support packages that target micro enterprises and SMEs separately

In Mozambique, 63% of MSMEs in the manufacturing sector are tax exempt, and 28% fall under a simplified tax system with reduced taxes (see Figure 1); only 9% pay standard taxes. Our sample is relatively formal, suggesting that in a representative sample of informal firms, even fewer would qualify for the standard tax system. As most of the Mozambican economy is composed of informal smallholders in agriculture and few service firms that add little value, it is unlikely for MSMEs in other sectors to benefit more from formalization or to hold more revenue than the manufacturing sector. Therefore, the potential revenue from formalization of MSMEs is limited. The low revenue potential of formalization of MSMEs implies that tax officials should focus on the tax compliance of larger firms.

The informal economy should be seen as a crucial job provider, especially for youth struggling to enter the formal job market. Instead of focusing solely on the urgency of formalization and the potential tax revenue from formalizing, the government should adopt an integrated approach to enhance the benefits of formalization.

Join the network

Join the network