Background Note

Debt sustainability and climate financing

Introduction

Since the outbreak of the COVID-19 pandemic, total public debt has increased by approximately 10 percentage points of global GDP. The most recent IMF Fiscal Monitor shows that debt rose from 103% to 109% of GDP in advanced economies, from 56% to 71% of GDP in middle-income economies, and from 43% to 53% of GDP in low-income economies.

At the same time, the need to finance climate-change-related expenditures and the fiscal costs associated with climate-related events increased significantly. This note explores the current challenges of climate change financing and their implications for debt sustainability.

The focus of this note is on climate change adaptation expenditures, which include activities such as investing in early-warning systems for disasters and diseases, developing strategies to address droughts and floods, and building or upgrading transportation, social, and coastal infrastructure. Adaptation efforts differ from mitigation expenditures, which aim to reduce global greenhouse gas emissions, and from loss and damage efforts, which address the costs of unavoidable harm that persist despite mitigation and adaptation measures.

The emphasis on adaptation expenditure is for two main reasons. First, it is the most relevant type of climate-related expenditure for the majority of emerging markets and developing economies (EMDEs). Second, unlike mitigation investments, which can often be undertaken by the private sector if proper regulations and carbon pricing are in place, adaptation efforts largely consist of public goods that must be financed through government revenues or by issuing public debt.

The challenge: high debt levels and climate change adaptation needs

This section describes the challenges faced by developing and emerging market countries. These countries are characterized by increasing debt levels and borrowing costs and, because of their vulnerability to climate change, have large needs for adaptation expenditure.

High debt levels and rising borrowing costs

After reaching a trough around 2005–07, debt ratios began increasing across all developing and emerging regions (Figure 1). Average debt levels remain relatively low in emerging Europe and Central Asia, where they rose from 20% of GDP in 2008 to about 30% of GDP in 2023. However, debt levels have increased rapidly in East Asia and the Pacific, Latin America and the Caribbean, the Middle East and North Africa, South Asia, and sub-Saharan Africa. Debt composition has also shifted, with domestic debt growing in importance in all regions except Europe and Central Asia.

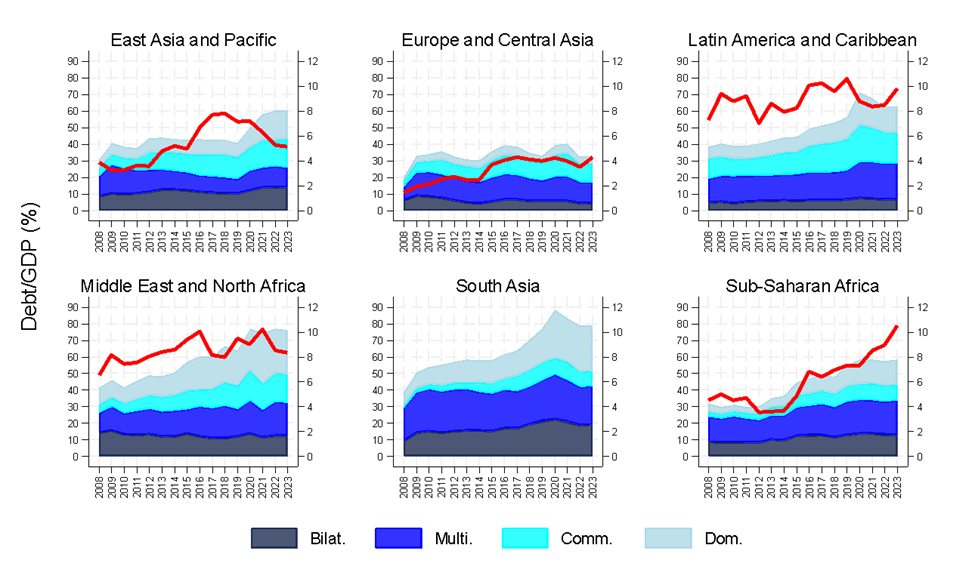

Figure 1: Debt levels and composition

Source: own elaboration based on data from World Bank’s International Debt Statistics and IMF’s World Economic Outlook (October 2024).

Regarding the composition of external debt, Diwan et al. document a recent decline in net transfers—the difference between new lending to these countries and debt amortization and interests payments—driven by a combination of increased lending by multilateral development banks and much larger negative net transfers by commercial creditors. These recent changes are not yet evident in the debt stocks shown in Figure 1, but if they continue, they will lead to shifts in the composition of external debt (with less commercial and more multilateral debt) and total debt (with an even greater share of domestic debt).

Changes in debt composition, combined with higher global interest rates, are also reflected in an increase in the average interest rate paid by developing and emerging economies. The red line in Figure 1 shows that the average effective interest rate (i.e., total interest payments over the total stock of debt) is now higher than it was before the global financial crisis and has risen rapidly in sub-Saharan Africa, which now relies on a smaller share of concessional debt.

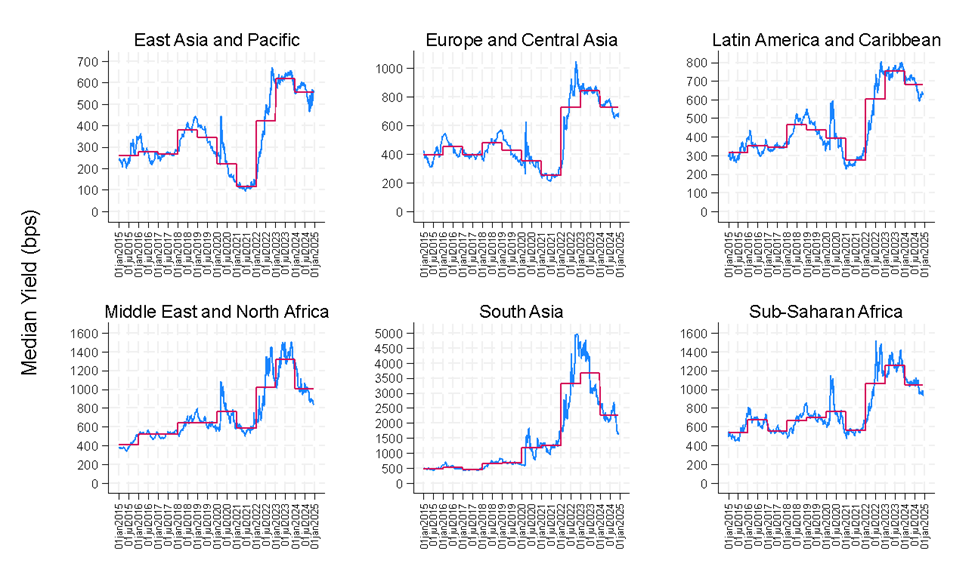

Bond yields are also substantially higher than they were 10 years ago, although they have decreased from the peaks reached during the acute phase of the COVID-19 pandemic (Figure 2). The high volatility of borrowing costs highlights that many countries still face precarious market access. High and volatile debt-service costs have led to a situation in which many developing and emerging economies are now spending more on interest payments than on essential sectors like health and education. This poses a serious risk to human well-being and underscores the urgent need for global action.

Figure 2: Median yields on sovereign bonds (2015–25)

Source: own elaborations from various data sources.

High costs of climate change and adaptation needs

There is a broad consensus that climate change negatively impacts GDP growth. For example, Acevedo et al. find that a 1°C temperature increase leads to a 2% decline in output and a 10% drop in investment over seven years in the median low-income country. Climate vulnerability also increases sovereign risk (i.e., the difference between the borrowing costs of countries deemed to have no credit risk, such as the United States and Germany, and those of emerging and developing economies). Studies by Kling et al., Beirne et al., Bolton et al., and Gomez-Gonzalez et al. show that countries with greater exposure to climate risks face persistently higher borrowing costs.

There is also evidence that emerging market and developing economies (EMDEs) are disproportionately vulnerable to climate-induced damages, due to their geographical positions in warmer climates, heavy reliance on climate-sensitive sectors such as agriculture and tourism, and limited capacity for adaptation investments. The most vulnerable regions are Asia (both South Asia and East Asia) and the Pacific, as well as sub-Saharan Africa (column 1 of Table 1). These vulnerabilities create a self-reinforcing cycle, whereby slower growth exacerbates fiscal fragility, increases borrowing costs, and further constrains investments in climate resilience.

The situation in sub-Saharan Africa is particularly concerning, as the region scores high in vulnerability and low in preparedness (compare columns 1 and 2 of Table 1). In contrast, advanced economies exhibit low vulnerability and high preparedness.

The situation in sub-Saharan Africa is particularly concerning, as the region scores high in vulnerability and low in preparedness (compare columns 1 and 2 of Table 1). In contrast, advanced economies exhibit low vulnerability and high preparedness.

Table 1: Climate change vulnerability and readiness and estimations of climate damages and adaptation needs

| Vulnerability score | Readiness score | Climate change damages | Adaptation needs | |

| Advanced economies | 0.34 | 0.66 | N.A. | N.A. |

| East Asia and Pacific | 0.50 | 0.42 | 19.05 | 1.72 |

| Europe & Central Asia | 0.37 | 0.44 | 5.85 | 0.84 |

| Latin Am. & the Carib. | 0.41 | 0.42 | 9.59 | 0.70 |

| Middle East & N. Africa | 0.42 | 0.31 | 7.79 | 0.81 |

| South Asia | 0.52 | 0.38 | 20.74 | 1.34 |

| Sub-Saharan Africa | 0.52 | 0.31 | 14.3 | 1.45 |

| Average EMDEs | 0.47 | 0.37 | 12.6 | 1.19 |

| Number of countries | 137 | 140 | 103 | 103 |

Note: the Vulnerability Index evaluates the impacts of climate change across various sectors by analyzing exposure, sensitivity, and adaptive capacity. The Readiness Index gauges a country's capability to implement adaptive investments effectively, considering economic, institutional, and social dimensions. Climate damage refers to the percentage deviation in projected output levels for 2050, comparing a scenario with no further temperature increase after 2023 to the business-as-usual (BAU) scenario. Adaptation needs represent the estimated annual spending required for a country to adapt to climate change, expressed as a percentage of GDP.

Source: own elaborations based on data from the Notre Dame Global Adaptation Initiative (ND-GAIN) and Butcher (2024).1

A good measure of economic vulnerability to climate change is the projected percentage deviation in economic output by 2050 between two scenarios: a Business-as-Usual (BAU) pathway, where global temperatures rise by 2.9°C by 2100, and a counterfactual scenario with no additional temperature increase after 2023. A large difference between these projections reflects a substantial negative growth impact from climate change. The average developing economy faces a growth gap exceeding 12% (column 3 of Table 1), with regional variations ranging from approximately 6% in Eastern Europe and Central Asia to 20% in South and East Asia.2 Damage estimates exhibit a strong correlation with the ND-GAIN Vulnerability Index.

Using data from various sources and employing a harmonization technique like that of UNEP, Butcher (2024) compiles a dataset on adaptation needs for 103 EMDEs.3 They are estimates of the annual expenditure (as a percentage of GDP) required by the public sector to adapt to climate change. The focus is on total public sector needs, which can be financed either domestically or through external support. On average, adaptation expenditures amount to slightly over 1% of GDP for EMDEs. However, this figure rises to approximately 2% of GDP in East Asia and the Pacific and 1.5% in sub-Saharan Africa. In contrast, adaptation needs are significantly lower in Europe, Latin America, and the Middle East (column 4 of Table 1). Adaptation needs are strongly correlated with climate change vulnerability and are close to 4% of GDP in several countries within the Asia-Pacific region.

Climate change damages and adaptation needs are not closely correlated with current debt levels (whether measured as the present value of external debt, the stock of public and publicly guaranteed external debt over GDP, or total debt over GDP). This lack of correlation suggests that blanket debt relief might not be the way to secure financing for adaptation expenditures. This is particularly true for EMDEs with limited debt-carrying capacities, where low levels of debt often reflect constrained fiscal space rather than an abundance of financial resources.

Research by Corugedo et al. and Batini et al. indicates that climate adaptation projects yield high benefit-cost ratios, with significant returns in terms of economic stability and growth. Given these high returns from adaptation expenditures, Bhattacharya et al. and Songwe et al. advocate for a ‘Big Push’ strategy that frontloads investments in adaptation and mitigation. While such a Big Push strategy offers the potential to build resilience and prevent long-term poverty traps, it also risks exacerbating debt burdens, particularly in countries already facing significant fiscal distress, and may not be feasible for those with limited debt-carrying capacity.

Three key obstacles hinder the implementation of Big Push adaptation efforts in EMDEs. First, there is a substantial funding gap. According to UNEP, finance flows of approximately US$21 billion cover less than 10% of adaptation needs, which range between US$215 billion and US$387 billion. Second, public investment in EMDEs is often hampered by inefficiencies and institutional constraints. This is critical because Adarov and Panizza show that high-quality public investment reduces sovereign risk, whereas poorly executed projects can exacerbate it. Third, barriers to project planning and implementation are particularly significant for climate adaptation projects. UNEP reports that climate change adaptation project disbursement rates between 2017–21 reached only 66% of planned levels, compared to 98% for other development finance initiatives.

There is thus a complex trade-off: neglecting climate adaptation magnifies economic and fiscal vulnerabilities. Yet, rapidly scaling up public investment could aggravate debt distress. To address this dilemma, several efforts have been made to augment standard debt sustainability analysis (DSA) with a climate change module. Attempts to incorporate external public investment needs for climate adaptation and sustainable development in the DSA framework find that additional investments could push most countries beyond debt solvency thresholds. Similarly, there is evidence that a Big Push scenario of 4% GDP investment through 2050 would require substantial concessional financing and improvements in domestic revenue mobilization.

The IMF’s Sovereign Risk and Debt Sustainability Framework (SRDSF) now integrates climate change into long-term debt assessments, incorporating adaptation investments over 30 years. Limitations to this framework include that it assumes adaptation fully offsets climate-related economic losses and it relies on regional averages, overlooking country-specific differences.

Building on Kessler and Albinet, and using the external debt solvency and liquidity thresholds from the IMF-World Bank Debt Sustainability Framework for Low-Income Countries, Butcher (2024)4 incorporates country-specific climate vulnerability data and accounts for residual climate damages despite adaptation efforts. His analysis explores different financing structures—market-rate financing, concessional loans, and a blended model—alongside three adaptation strategies: no investment, a Big Push (frontloading investments in the first 10 years), and a Slow and Steady approach (gradual investments from 2024–50).

He finds that without adaptation investments, climate change substantially reduces economic output and pushes 1 in 5 of EMDE countries analysed into debt distress. The Big Push strategy improves long-term solvency but heightens short-term debt risks, with 7 in 10 countries breaching liquidity thresholds under market financing—though this falls to 41% with full concessional financing. As for the Slow and Steady approach, the risk of debt distress during the transition period is reduced, but countries end up with much higher debt ratios.

Solvency risks are most severe in sub-Saharan Africa and small island states, while liquidity risks are widespread across Asia, Africa, and the Caribbean. While the Big Push ultimately improves debt ratios, its success hinges on avoiding costly debt crises, underscoring the need for concessional financing to ensure financial stability.

Paradoxically, this analysis suggests that, in the absence of concessional financing, doing nothing is the optimal strategy. However, this is a misguided conclusion. Policies should aim to maximize welfare. Debt sustainability is relevant only to the extent that it impacts welfare. The Big Push strategy, by fostering growth and likely reducing poverty through its growth effects, emerges as the most desirable approach. The need of the hour is to find effective ways to finance this strategy while avoiding debt crises, which could have profoundly negative consequences for both growth and social expenditure.

Policy solutions

While all estimates are subject to substantial uncertainty and often rely on heroic assumptions, the general message remains clear: rapidly scaling up adaptation investments poses large risks to debt sustainability. This highlights the need for a comprehensive strategy to finance adaptation efforts while avoiding costly debt crises. Such a strategy should integrate concessional financing, grants, debt restructuring, sustainability linked financial instruments, and a well-functioning carbon market. The international community should prioritize the following key tasks.5

First, advanced economies and high-emitting nations must commit to annual fiscal support for adaptation, mitigation, and green transitions in developing countries. This support should be delivered as outright grants or highly concessional loans, tailored to the recipient country's debt situation and debt-carrying capacity. Such fiscal support should be tied to clear objectives, including adaptation investments and the development of low-emission technologies.

Second, a comprehensive global carbon credit market should be established, requiring mandatory CO2 emission reduction targets for large emitters and standardized mechanisms for certification, monitoring, and trading. This market would enable resource flows from wealthier to poorer nations. Although not all EMDEs may benefit equally, countries with natural assets like carbon sinks could monetize these resources and use the proceeds to finance green investments without accumulating debts. For example, research indicates that protecting the Amazon biome could be achieved with relatively modest carbon pricing.

Third, sustainability-linked sovereign bonds should be developed. These bonds, contingent on achieving environmental targets, provide greater flexibility and adaptability than traditional green bonds, enabling innovation while maintaining accountability. Multilateral Development Banks and NGOs can play a critical role in designing these bonds and monitoring performance indicators. For countries that prefer issuing standard green bonds, their credibility should be bolstered through a clear legal framework, verification mechanisms, and penalties for non-compliance.

Fourth, debt sustainability analyses must explicitly account for the fiscal costs of climate-related expenditures. Given the inherent margins of error in DSAs, the international community should promote symmetric contingent debt instruments. These are instruments in which payments increase when economic conditions are favourable and decrease when they are not favourable. All contingent instruments issued so far are asymmetric because they have interest rates or payment that increase under favourable conditions but not the other way around. Such instruments would be more effective, and discourage asymmetric instruments, which have been both costly and ineffective.

Fifth, for countries with unsustainable debt levels, debt restructuring must fully incorporate the impacts of climate change on revenues and government expenditures. This should be paired with climate-linked conditionality. One effective approach is exchanging restructured debt for sustainability-linked bonds, ensuring enforceable commitments to climate-related objectives.

Sixth, debt-for-nature swaps—agreements in which a country receives debt relief in exchange of a commitment to protect its natural resources—should be improved by linking them to broader budgetary or climate commitments rather than individual projects. These swaps should ensure that climate-related expenditures are honoured even during debt restructuring, potentially through pre-funded accounts or guarantees provided by MDBs or bilateral agencies.

These tools must be implemented while acknowledging their limitations and trade-offs. Addressing climate change will require significant fiscal support and resource flows from wealthier to poorer nations, enabling green transitions without repeating the environmentally harmful paths taken by today’s large emitters. This will necessitate strong political will from high-income countries to commit resources and from developing countries to prioritize green development. Unfortunately, decisions such as the U.S. administration's withdrawal from the Paris Agreement cast doubt on the prospects for collective action.

Endnotes

1 Butcher, B. (2024). Adapting to a Warming World, unpublished. Geneva: Geneva Graduate Institute.

2 Climate damage data are from the BAU scenario of the Network of Central Banks and Supervisors for Greening the Financial System, available here.

3 Butcher, Adapting to a Warming World.

4 Butcher, Adapting to a Warming World.

5 For details on some of these policy proposals, see Bolton et al.

Join the network

Join the network