Research Brief

Dynamics of domestic revenue mobilization

Are moderate increases more sustainable?

Domestic revenue mobilization (DRM) — the generation of government revenue from domestic tax and non-tax resources — plays a crucial role in building an enduring financing architecture for sustainable development. This brief summarizes the dynamics of DRM trends across the past four decades. Analysis reveals that more notable changes in government revenues on a global level took place in the early-to-late 2000s. In addition, moderate increases yielded better tax or revenue positions in the late 2010s, compared to fast and high increases.

High and moderate increases in total revenue and tax peaked globally during the early-to-late 2000s

Sub-Saharan Africa represents the largest share of countries with high increases in total tax ratios in the early-to-late 2000s, which remained comparatively high in the following period.

Natural resource-dependent countries indicate a greater volatility in levels and composition of government revenues

Moderate increases in total tax and total revenue ratios appear to be more sustainable going forward

DRM dynamics – consistent trend comparisons

This brief explores the question: how have total revenue and total tax statistics changed across the past four decades? To arrive at meaningful comparisons of DRM trends, the analysis focussed on three key principles:

1. Aggregation across time. This approach defines ten years as a period of observation. Within those, five-year rolling averages were compared. Doing so allows incorporating (i) shorter-term fluctuations and (ii) DRM dynamics, for example, at the beginning and end of each decade.

2. Adequate thresholds. The IMF suggests a benchmark of 0.5 percentage point (pp) increases in tax to GDP ratios per annum to gauge progress for developing countries. This threshold was applied to classify DRM trends by direction (increase or decrease) as well as intensity (low, moderate, high). Applied to a five-year period, a high decrease or increase was defined as a change above (+/-) 2.5 pp, a moderate decrease or increase below (+/-) 2.5 and above (+/-) 1.25 pp and a low decrease or increase below (+/-) 1.25 pp.

2. Adequate thresholds. The IMF suggests a benchmark of 0.5 percentage point (pp) increases in tax to GDP ratios per annum to gauge progress for developing countries. This threshold was applied to classify DRM trends by direction (increase or decrease) as well as intensity (low, moderate, high). Applied to a five-year period, a high decrease or increase was defined as a change above (+/-) 2.5 pp, a moderate decrease or increase below (+/-) 2.5 and above (+/-) 1.25 pp and a low decrease or increase below (+/-) 1.25 pp.

3. Sustained trends. The presented approach combines the direction and intensity of an observed trend dynamic to see whether both have been sustained over time. This way it is possible to examine whether countries that started with a high or moderate increase of government revenues in the early-to-late 2000s were able to maintain such trends.

Sub-Saharan Africa – driving increase in tax ratios in the early-to-late 2000s

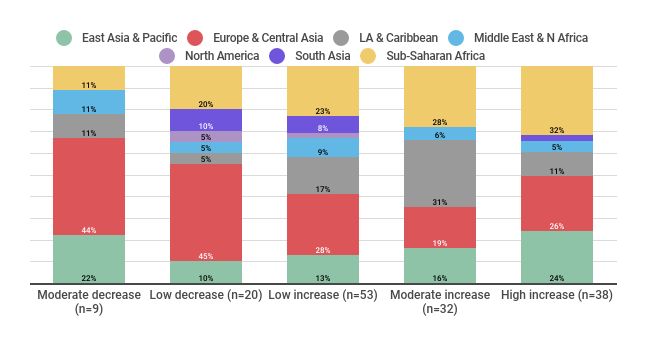

The analysis reveals a global shift towards moderate or high increases in tax and revenue ratios during the early-to-late 2000s in comparison with previous decades. Yet, this does not apply uniformly to all regions (Figure 1).

Figure 1: Trends in tax-to-GDP ratios, early 2000s – late 2000s, by region

Sub-Saharan Africa (SSA) holds the greatest share among countries that show high increases in total tax ratios, followed by Europe and Central Asia. At the same time, SSA shows a lower representation among countries with low or moderate decreases in total tax revenue.

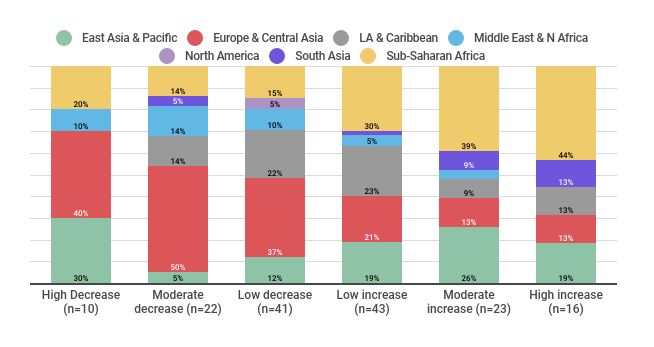

In the following period, the late 2000s to early 2010s, the number of ‘high increasers’ (i.e., countries that witnessed a growth in their total tax ratio at least by 2.5 pp compared to the previous observation period) more than halved on a global level (Figure 2).

Figure 2: Trends in tax-to-GDP ratios, late 2000s – early 2010s, by region

This trend was also reflected in SSA’s representation among ‘high increasers’, though to a lesser extent. In comparison with preceding decades, the results suggest that SSA countries were driving a notable share of the trends toward increasing tax ratios throughout the early-to-late 2000s. High increases in total tax ratios were also more lasting in SSA in the late 2000s to early 2010s. However, during the most recent period (the early-to-late 2010s), SSA appeared more evenly represented across all different trend levels. This also includes a comparatively higher representation of SSA countries among those with high or moderate decreases.

Are moderate trends more sustainable?

With a key focus on comparisons across time, the analysis also looked at the continuity of trends. As previously shown, the global shift in the early-to-late 2000s towards moderate or high increases in tax and revenue ratios was not sustained. This is possibly due to the global financial crisis which brought forth fiscal stimuli and austerity measures. Yet, as seen in the case of SSA, a notable number of developing countries was able to sustain the increases in tax and revenue ratios. This suggests that they might have been more ‘immune’ to the financial repercussions of the 2008-09 crisis. However, this does not hold true for countries which rely more strongly on revenues from hydrocarbons or minerals to generate revenue where trends were more volatile.

Global events, such as the financial crisis of 2008-09, affect DRM in manifold ways. This is also relevant for understanding the financial repercussions and potential set-backs of the COVID-19 crisis

Understanding tax systems with moderate but sustained DRM growth can provide important insights on efficient and adaptive tax system design

Comparing the identified patterns in DRM with the funding needed to meet the UN’s SDGs can provide insights on potential financing gaps.

Focussing on the continuity of trends more broadly, the analysis showed that moderate increases were sustained to a greater extent. Countries that started out with high increases in government revenues overall ended up with lower rates of further improvement, compared to those that started with moderate increases in the early-to-late 2000s. Hereby, countries with moderate increases in the early-to-late 2000s were, on average, in better tax or revenue positions by the late 2010s. Based on this tentative evidence, the authors propose further explorations on whether moderate trends are indicative of more sustainable growth in domestic revenues.

Join the network

Join the network