Research Brief

The employment and poverty effects of in-work policies in Ecuador

Governments in low- and middle-income countries face a trade-off between raising tax revenue to strengthen social protection and creating incentives to enter formal employment. In developed countries so called in-work transfers (i.e., social benefits paid upon condition of being employed) have been considered as an alternative to offer income protection to low-earner households and to provide incentives for labour market participation. Thanks to ECUAMOD, the tax-benefit microsimulation model for Ecuador, it is possible to analyse the employment and poverty effects of a hypothetical in-work child credit in the South American context.

Informal employment in Ecuador has remained at around 60% over the last decade

Female informal employment has become more prevalent since 2014, representing 66% of female employment in 2019

A simulated in-work child credit would have a positive effect on female formal employment and would reduce income poverty

Female formal employment would increase as a result of a reduction in non-participation and informal employment

Poverty and extreme poverty rates would decrease due to the direct effect of the in-work child credit on income and to its indirect effect through the increase in formal employment

Informal employment remains a prevalent problem in the developing world. In Ecuador, informal employment has remained at around 60% over the last decade, despite an important drop from 2000 to 2010. Moreover, female informal employment in Ecuador has become more prevalent since 2014, representing 66% of female employment in 2019 compared to 62% for men. In this context, designing policies aimed at creating incentives for women to enter formal employment seems highly relevant.

In this analysis, ECUAMOD is combined with a labour supply model to simulate the employment and poverty effects of a hypothetical in-work child credit destined to low-paid female workers in formal employment.

The analysis takes tax-benefit policies in place in 2019 as a starting point, applied to the December 2019 National Survey of Employment, Unemployment and Underemployment of Urban and Rural Households (ENEMDU). The simulated in-work child credit has the following characteristics. The transfer is designed for families (couples or single mothers) with children aged below 18 and in education. To be eligible, the mother needs to be in formal employment, working more than 10 hours per week and earning less than 1.5 times the minimum wage. The benefit amount is US$50 per month paid to the mother.

The design of the hypothetical in-work child credit aims to provide income protection to low-earning female workers and to create incentives for them to enter formal employment.

The employment effects of a simulated in-work child credit

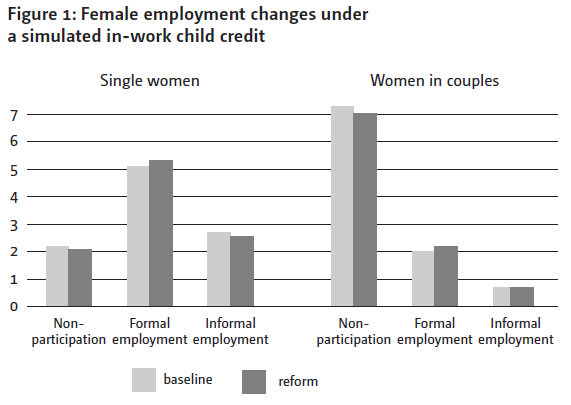

Predicted frequencies from the estimated labour supply model (Figure 1) show that the hypothetical in-work child credit would have a positive effect on female formal employment for both single women and women in couples. For single females, formal employment would increase by 2.1 percentage points as a result of a 0.9 percentage point reduction in non-participation (i.e., being out of work) and a 1.2 percentage point drop in informal employment. For women in couples, formal employment would increase by 1.6 percentage points but mostly through increased participation (1.5 percentage points) rather than a reduction in informal employment (0.1 percentage points).

Thus, the simulated in-work child credit seems to generate incentives for female workers to enter formal employment either by participating in the labour market while they were previously out of work or by exiting informal employment. The larger response in terms of participation of women in couples might be explained by the larger proportion of them in the non-participation category in the baseline scenario.

Impact on income poverty

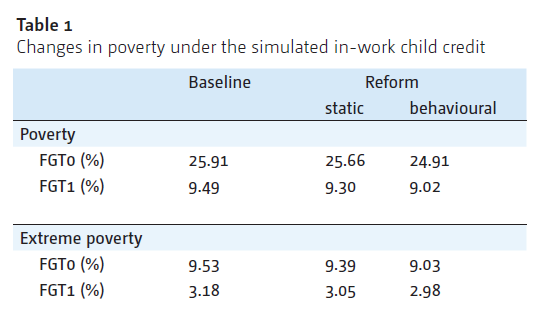

The analysis shows that the simulated in-work child credit would decrease income poverty slightly (Table 1). Static simulations without taking employment changes into account show a decrease in the national poverty rate (FGT0) from 25.91% to 25.66%. Behavioural simulations which account for employment changes result in a larger reduction in poverty, with a national poverty rate of 24.91%. The additional decrease in poverty is explained by the increase in formal employment following moves out of non-participation and informal employment (see Figure 1).

The national extreme poverty rate would decrease from 9.53% in the baseline scenario to 9.03% with the introduction of an in-work child credit taking into account changes in employment. The effect on the poverty gap (FGT1) is in line with that observed for poverty rates, with a larger drop when employment changes are taken into account.

Enhancing income protection and strengthening work incentives

Governments in low- and middle-income countries generally need to balance two important objectives: enhancing social protection and strengthening incentives to enter formal employment. These results presented here for Ecuador indicate that in-work policies might represent an alternative to achieve these objectives.

Governments in low- and middle-income countries generally need to balance the need to enhance social protection and to strengthen incentives to enter formal employment

In-work policies might represent an alternative to achieve these two objectives

More generally, the potential effects of different tax reforms aimed at increasing fiscal capacity should be assessed in view of financing sustainable social protection systems

Tax-benefit microsimulation complemented with models capturing individual reactions in the labour market represent useful tools for predictive ex-ante policy analysis

However, in-work policies should not be the only option considered by low- and middle-income countries. Policymakers should consider a holistic approach, assessing the potential effects of different tax reforms (e.g., including reforms to direct and indirect taxes, corporate and wealth taxes) aimed at increasing fiscal capacity in the long term to finance sustainable social protection systems. Tax-benefit microsimulation complemented with models capturing individual responses in the labour market represent useful tools for such exercises.

Join the network

Join the network