Blog

From offshore oil to offshore finance

How tax havens facilitate corruption in the extractive industries

In many countries, news of an oil discovery or the award of an exploration license is rarely greeted with enthusiasm by the general public. Any hopes of widespread development quickly vanish once people realize only a small elite group stands to benefit.

Estimates of global foreign bribery suggest that 20% of transnational bribes are linked to the extractive sector. Corruption is rampant in the oil, gas, and mining industries. Fighting corruption is difficult because detecting corruption is a hard task, and the widespread usage of offshore shell companies makes it even harder. We studied how new shell companies systematically spring up in offshore tax havens following oil licensing and oil booms, providing financial vehicles for widespread corruption.

Tax havens allow corrupt actors – such as corrupt government officials – to conceal their identity behind layers of secrecy. If identifying the owner of a shell company is almost impossible, identifying the origin of the funds a shell company hosts is equally so.

Recent developments in investigative journalism, such as the Panama Papers and Paradise Papers, unveiled the names of the beneficiaries of thousands of shell companies. The leaks offered an unprecedented opportunity to understand the mechanisms behind corruption in the extractive sector. For the first time, not only government investigators, but also private citizens and researchers could see the names of the people involved in offshore finance.

A critical moment for corruption

The awarding of exploration licenses for oil blocks is a very delicate moment for countries relying on extractive industries. Exploration licenses are usually awarded by ministries, public authorities, or local governments, and they give the license holder the exclusive right to explore for oil and gas within the specified block. The high discretion in the awarding process coupled with huge values of the contracts opens the door to rent-seeking behaviour.

The Natural Resource Governance Institute (NRGI) studied 100 real-world cases of corruption in the awarding of licenses and contracts in the extractive sector. Their analysis shows the central role that shell companies play in facilitating corruption. For example, contracts are awarded to shell companies lacking capabilities and infrastructures to carry out the project. The ultimate beneficiaries of those companies are usually politically-exposed persons. In another example, politicians or government officials siphon part of the contract signing bonus away from the government’s coffers and to their offshore personal accounts. Or, companies participating in the awarding round bribe government officials processing payments through offshore shell companies.

Linking license awards to increase in offshore companies

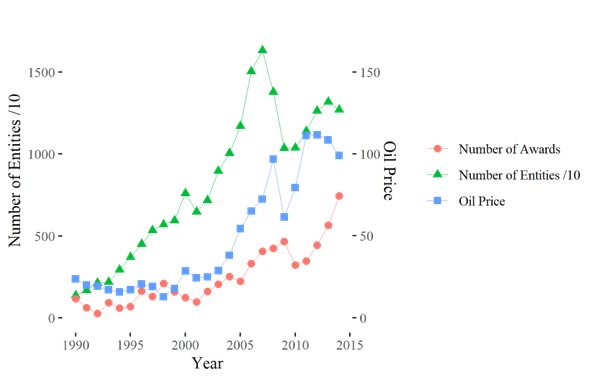

Our recent research for UNU-WIDER linked information from the Offshore Leaks Database to the timing of awards of oil exploration licenses. Our data, which covered 119 countries over the period 1990-2014, showed that within six months of awarding a license the number of entities in tax havens increased by 11% on average. In other words, we found a link between the issuance of oil exploration licenses and the founding of shell companies, presumably to facilitate corruption. The increase was even higher if the licensing round occurred during an oil boom (Figure 1).

Why are countries turning to offshore finance more frequently around the award of an oil license? Why do they divert funds to places where it is harder to trace their origin? Why are they more likely to do so when the price of oil increases?

A possible interpretation is that shell companies work as vehicles to channel corrupt money and the surge in their number captures corruption during the award period. Tax havens serve well the need for secrecy of corrupt officials, by making their wealth difficult to trace. Also, when oil prices increase, more opportunities for rent extraction arise.

Our analysis provides the first systematic piece of evidence of the ties between the awarding of contracts and the role of shell companies. As the disclaimer on the Offshore Leaks Database suggests, there are legitimate uses of shell companies. Nonetheless, more transparency is needed during the awarding of contracts in the extractive sector. Identifying the ultimate beneficiaries of shell companies involved in the award process would not only improve efficiency, but hopefully reduce corruption.

Giovanna Marcolongo is a postdoctoral fellow at the CLEAN Research Unit, Bocconi University. Her main area of research is political economy, with a particular focus on the economics of crime and corruption.

Diego Zambiasi is a lecturer in Economics at Newcastle University Business School. He is an applied microeconomist and his research focuses on the economics of crime and the economics of migration.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network