Research Brief

Simplifying the tax filing of small businesses in Uganda

Does it make a difference?

How could countries in the Global South develop their tax systems further and improve compliance? This analysis shows how two tax administration interventions impacted the number of small business taxpayers and presumptive tax revenues in Uganda.

One-stop-shops — where citizens could register for several authorities at the same visit and receive information — were the most successful policy in registration campaigns. They increased the number of taxpayers by approximately 70%

Simplified tax return form of presumptive tax doubled the number of tax filers after 2015

Enforcement services and provision of information in one-stop shops and lowering the compliance costs are the most feasible mechanisms for increasing the numbers of tax filers

Both interventions led to presumptive tax revenue gains as after the interventions more small businesses filed taxes

The taxpayer register expansion project (TREP) was highly cost-effective

Developing countries have been able to increase their tax revenue in the last decades, but overall revenues have often remained too low to sustain provision of crucially important public goods. Small businesses are an important part of the economy and an appealing target group for tax authorities in many of these countries. However, as operate mostly in the informal sector they are hard to catch into the tax net.

In Uganda, the informal sector covers half of the economy and only a small fraction of employees work on the formal sector. Broadening the tax base by formalizing small businesses is one important step for enhancing the domestic resource mobilization in the country.

Many low-income countries have a dedicated tax regime for small businesses, usually referred as a presumptive tax, in which tax is based on businesses’ sales instead of profits. In Uganda, a presumptive tax regime is designed for small businesses who cannot keep comprehensive records of their sales and hence tax liability is calculated from estimated sales.

Two interventions to improve tax administration and compliance of small businesses

The Uganda Revenue Authority (URA) with local governments and the Uganda Registration Services Bureau (URSB) initiated a taxpayer register expansion project (TREP) in 2013 to improve tax compliance by formalizing and educating businesses. Two years later in 2015, the URA introduced a new electronic system, e-filing, for presumptive tax which simplified tax filing of small businesses.

The Uganda Revenue Authority (URA) with local governments and the Uganda Registration Services Bureau (URSB) initiated a taxpayer register expansion project (TREP) in 2013 to improve tax compliance by formalizing and educating businesses. Two years later in 2015, the URA introduced a new electronic system, e-filing, for presumptive tax which simplified tax filing of small businesses.

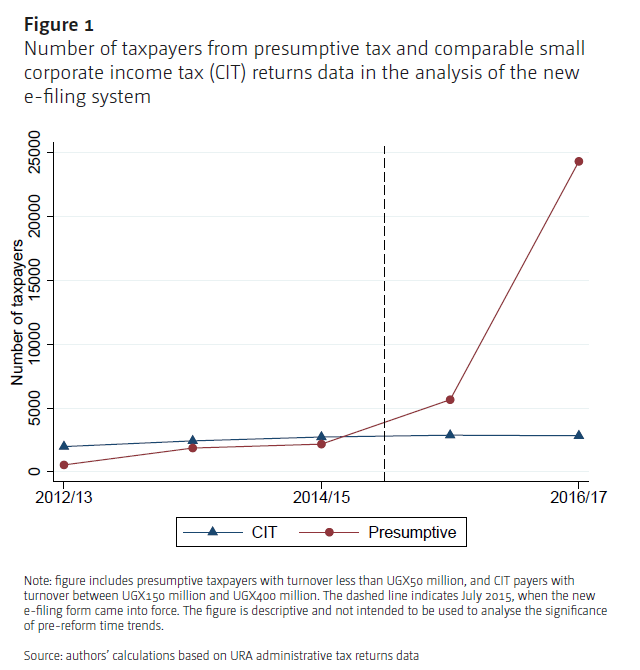

Using administrative data from the Uganda Revenue Authority this analysis compares the number of taxpayers in different geographical areas and industries to uncover the impact of these interventions, whose introduction varied across regions and time. The data covers both presumptive taxpayers and comparable small corporate income tax (CIT) payers.

More businesses file tax returns

The results show that both interventions increased the number of small businesses filing their taxes. The analysis indicates that the type of the intervention matters in the taxpayer registration campaign. The number of tax filers increased approximately by 70% when one-stop shops — where citizens could register for several authorities at the same visit — were established, but less than 50% in the first years when TREP mainly included door-to-door visits to businesses.

The new e-filing form had a large impact on tax compliance and it almost doubled the number of presumptive taxpayers after its introduction. In addition, the results indicate that the TREP and the new e-filing system complemented each other. This result is associated with one-stop shops because they not only increased enforcement but also educated taxpayers to comply tax obligations which lowers their compliance costs.

Who are these new tax filers? The descriptive analysis shows that most of the presumptive taxpayers file their tax returns only in one year and not in the next year. Furthermore, most of the new presumptive taxpayers file the lowest possible taxable amount of sales.

Overall, two interventions enhanced tax compliance, but only for smallest businesses and they did not manage to keep small businesses on board for several years. The reason for this might be the low enforcement capacity of tax officials. In general, enforcement operations in low-income countries with limited administrative capacity focus on large firms from which most of the tax revenues arise.

Interventions led to revenue gains

This analysis further investigates if the two interventions affected presumptive tax revenues. Both interventions approximately doubled presumptive tax collection. Similarly, as for the number of taxpayers, the establishment of one-stop shops was a crucial initiative to raise more revenue from small businesses. Overall, presumptive tax revenue increased from 0.01% of gross tax revenues in the financial year 2015–16 to 0.04% in 2016–17. These numbers show that presumptive tax is still a minor source for tax revenues in Uganda, but there is potential for the share to grow.

Finally, the study shows that tax revenue gains from TREP outweighed URA’s budgeted costs for TREP which suggests that the taxpayer registration campaign was a cost-effective intervention. The cost-effectiveness of the new e-filing system was not possible to study because of the lack of information.

Small businesses should have easier access to services

These results indicate that easier access to government services —such as tax registration, filing and paying — should be facilitated. In particular, one-stop shops help citizens to register for taxes and they can be provided cost-effectively. Taxpayer registration services should include tax education as a lack of information can hinder tax filing.

One-stop shops are a good way to improve tax compliance as they help citizens to register for taxes, and they can be provided cost-effectively

Taxpayer registration services should include tax education as a lack of information can hinder tax filing

The electronic tax forms for small businesses should be made simpler than for larger firms, to lower compliance costs of small enterprises

The physical access is not the only solution. Digital services can also play an important role. Findings of this analysis point out that the electronic tax forms for small businesses should be simpler than for larger firms, to lower the compliance costs of small enterprises.

Join the network

Join the network