Blog

South Africa’s new retirement savings system: will it reshape financial security?

Launched on 1 September 2024, South Africa's two-pot retirement system is designed to offer greater flexibility in managing retirement savings. This system allows individuals to access a portion of their retirement funds before retirement through a ‘savings pot’, while a ‘retirement pot’ remains inaccessible until retirement.

As of 11 October 2024, ZAR 21.4 billion in withdrawals have been applied for through the system, reflecting considerable early engagement with this new access to savings. Withdrawals from the savings pot are subject to tax at the saver's marginal tax rate. This approach provides immediate access to savings but introduces a tax liability at the point of withdrawal, which differs from the traditional method of deferring taxation until retirement. While the system offers flexibility, it raises questions about the long-term impact on retirement savings and how tax policy may influence individual decisions.

Financial experts caution that this added flexibility comes with risks. While early access to funds offers a lifeline during financial emergencies, it can leave some individuals with insufficient funds later in life. Projections show that frequent withdrawals from the savings pot could reduce total lifetime retirement savings from nine times the saver's average annual salary to just two or three times. There are concerns that the savings pot could jeopardize future financial security, particularly for lower-income earners. To address these challenges, strategic tax policy reforms might be made to further incentivize smart retirement decisions. We discuss several of these in an SA-TIED Working Paper.

Exploring tax credits as reform option

A challenge in South Africa’s retirement savings landscape is the disparity in tax benefits for different income levels. Currently, higher-income earners get more tax savings from tax deductions than lower-income earners due to their higher marginal tax rates. They also often contribute more to retirement savings to further increase the size of their deduction. This creates an unequal benefit distribution, with lower-income earners not receiving equivalent incentives from the current system. This disparity means that existing system of tax deductions disproportionately benefits higher income earners. Introducing tax credits alongside the two-pot system could create a more equitable retirement savings structure. We found that reform options which replace deductions on retirement contributions with a tax credit system could reduce inequality in South Africa after income tax.

In the 2019/20 tax year, the average retirement contribution was ZAR 39,121, while top earners—with annual earnings above ZAR 1.5 million—averaged ZAR 175,193. While minimum contributions to employer-provided retirement funds are often automatically deducted from payrolls, higher-income earners tend to make additional voluntary contributions. Because retirement contributions are tax-deductible, the current system provides a bigger incentive to high earners to save, which may entrench existing inequalities. In contrast, a tax credit system for retirement contributions would provide the same rate of tax savings for all income levels. Thus the incentive to save is not skewed toward the top of the distribution.

Our results

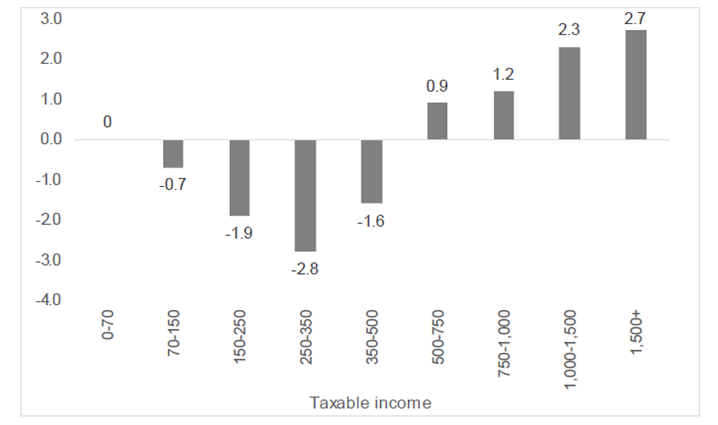

We used the Personal Income Tax Microsimulation Model (PITMOD) to estimate how such a reform would impact government revenues and icome inequality levels. PITMOD simulates tax policy reforms, allowing us to see how a transition to a tax credit system might impact outcomes for various income groups. We also compared different conversion rates, the rate at which contributions are converted to tax credits. For example, a 26% conversion rate means that 26% of the annual contribution is returned as a tax credit. Our findings suggest that a 26% conversion rate is a viable option. This reform option would increase tax liability for the highest income groups while reducing it for lower earners, making the system more progressive. In the 2019/20 tax year, the tax credit at a 26% rate would have also generated ZAR 22.7 billion in additional tax revenue, a 4.2% increase compared to the current tax system. This additional revenue could fund, for example, a monthly increase of ZAR 518 to recipients of the old age grant.

Figure 1: Percentage point difference in tax liability between baseline and reform scenario encouraging retirement savings reform

Source: Authors’ illustration based on PITMOD output.

South Africa has a comprehensive social welfare system that provides grants to vulnerable groups, including the elderly. The old-age grant is a vital lifeline for millions of South Africans who rely on it for their basic needs. However, the government faces significant fiscal constraints, and there is growing concern that the current system may not be fiscally sustainable in the long term. Overall, a transition to tax credits would be a positive step toward a more equitable retirement savings system. While the new two-pot system has its benefits, it also carries the risk of undermining long-term financial security. Our proposal attempts to mitigate these risks by encouraging long-term savings equally across income groups.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network