Research Brief

Technology, tourism, malls, and metros

Promises and pitfalls of tradable services in Africa

There is growing recognition around the world that tradable services can play a valuable role in economic development. Africa is no exception, with the need for multiple routes to growth, particularly vis-à-vis the COVID-19 pandemic.

Tradable services — business activities that can be exported or that replace imports — present opportunities to boost economic growth in Africa, both directly and indirectly

South African companies have more experience of trade and investment elsewhere in Africa than is commonly understood

However, their track record in tradable services is very mixed. Their services have been geared more towards consumers than expanding production in the real economy or improving urban infrastructure

There has been no comprehensive vision on the contribution South African tradable services companies could make to harness the advantages of urbanization

Tradable services are business activities that can be exported or can replace imports. They range from relatively low value transport, tourism and conference services to knowledge-intensive business, financial, technology and engineering services. The recent creation of the African Continental Free Trade Area should assist their expansion.

Tradable services and economic development

The exchange of services provides different countries with exposure to facilities and expertise which would otherwise not be available to them. It also generates foreign currency for the exporters. Tradable services can contribute indirectly to economic development in both outbound and inbound countries by helping firms in other sectors — such as agriculture, mining and manufacturing — to upgrade their capabilities and value chains.

Tradable services can make public infrastructure and government functions more effective by providing advanced know-how. Unsurprisingly, there is growing competition worldwide to supply these specialized services to emerging economies.

The experience of South African companies

South African (SA) companies have more experience of trade and investment elsewhere in Africa than is commonly understood. However, their track record in tradable services is very mixed.

There is no comprehensive data available on the extent of SA companies’ involvement in other African countries. The Financial Times’ FDI Markets database is currently the best information source. The database focuses on foreign direct investment (FDI) – the most important mode of tradable service activity.

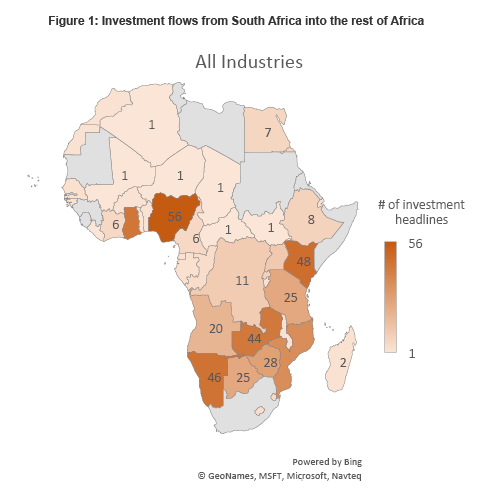

According to the database there were 492 projects undertaken by SA companies elsewhere in Africa between 2003–19, with an estimated value of USD38 billion and 60,000 jobs created (see Figure 1). Nearly three-quarters (73%) of these projects were in services. This is surprisingly high, considering SA’s established strengths in mining and manufacturing. Financial services dominated with 139 projects, followed by telecoms (82), construction (38), media and marketing (37), and other business services (33).

These projects varied greatly in size, measured by investment value and jobs created. Individual projects in financial and business services tended to be much smaller in both respects than projects in mining, manufacturing, energy and construction. Nevertheless, services still constituted almost half of all FDI by investment value, and just over half of all jobs. This is an important finding.

Two other features of these projects stand out. First, they are quite disjointed across different sectors, territories and timescales. SA companies tend to go it alone when investing abroad, resulting in a pattern of hit-or-miss. There are few combined efforts to build value chains, economic clusters or connective infrastructure. Almost every African country has had at least one project, and the most populous countries have had the most projects. Proximity also matters, with more projects going to southern African countries than those further afield.

A focus on consumption, not on production

Second, SA investments have been geared more towards meeting the demands of under-served consumers than expanding production in the real economy or improving public infrastructure. This is apparent in the dominance of retail banking, insurance, telecoms, marketing and logistics to facilitate imported consumer goods and health products.

Within the construction sector, the largest type of activity has been shopping centres. SA property investors and developers have joined forces with leading SA retailers to build malls in many African cities. They have tended to use South African professional service providers and suppliers of building materials. The retailers have also been inclined to fill their shelves with imported goods from SA suppliers rather than supporting local production.

One-sided relationships?

There have been understandable concerns raised about the one-sided and extractive nature of SA’s trade and investment relationships with other African economies. This has also been evident in the tradition for service providers to fly their experts in and out. African governments have reacted with growing demands to localize business services. This would mean opening in-country offices and forming joint ventures with local firms to help transfer skills and capabilities.

The SA government has also been concerned about the external reputation of SA companies, and has introduced guidelines to moderate inequitable practices. However, it has failed to formulate a positive vision of the contribution they could make. The government recognises the value of building strategic transport corridors across Africa, but neglects the role SA companies could play in helping to build well-functioning cities.

Governments should recognise and enable the efforts of companies in tradable services to expand elsewhere in Africa, starting with awareness-raising and networking

A targeted approach to particular sectors and territories is likely to be most effective, based on a thorough understanding of the risks and rewards in different markets

Urbanization should be seen as a unique opportunity to accelerate economic and social development, linked with industrialization, infrastructure, and stronger local institutions

This requires a co-ordinated approach across government and the private sector to marshal their combined knowledge and resources

Meanwhile, many SA firms have discovered that trading conditions are more difficult than expected and have scaled back their operations in many countries. There are not enough middle-class consumers with formal jobs to afford their products and services, reflecting weaknesses in the real economy. Competition from other global corporations with sophisticated supply chains has also intensified in several sectors. It seems that the restricted approach of many SA companies towards African trade and investment has come back to bite.

Join the network

Join the network