Policy Brief

Distributional effects of the COVID-19 pandemic in Ghana

The first cases of COVID-19 in sub-Saharan Africa were reported in March 2020, and the impact of the pandemic has since rippled through the world and Africa. In response to the crisis and similarly to many of its peers, Ghana has enacted a variety of containment measures to confront the pandemic, and a variety of tax-benefit measures to protect society from the severely reduced economic activity.

Ghana’s economy was severely hit by the COVID-19 crisis in 2020, with tourism and services sectors most, and agricultural sectors least affected

The government implemented various discretionary policy measures in addition to the general tax-benefit system that was in place before the crisis

Supporting policy measures were successfully directed at lowest income households

However, with lockdowns the national school feeding programme largely stopped, which more than offset the beneficial effects of those measures, leading to a further increase in poverty

The general tax-benefit system barely cushioned against earnings losses that households suffered in 2020

The Ghanaian government initiated a variety of discretionary measures – the most important were personal income tax waivers for frontline and medical personnel, waivers/reduction of utility tariffs, and additional food rations for some beneficiaries of the country’s largest cash transfer programme, the Livelihood Empowerment Against Poverty programme (LEAP). At the same time, strict lockdown measures also meant that schools were closed for the greater part of 2020, and the country’s largest social protection programme, the school feeding programme for children enrolled in public schools, came to a halt.

To quantify and understand the pandemic’s impact on household welfare, one needs to disentangle the magnitude of the economic shock across sectors on earnings, and the impact of the general tax-benefit system and discretionary policy measures taken in response to the crisis on household disposable income and ultimately consumption. GHAMOD, the tax-benefit microsimulation model for Ghana, allows for impact analysis. The analysis focuses on the first nine months of the pandemic in 2020.

Unequal shocks across industries

Unequal shocks across industries

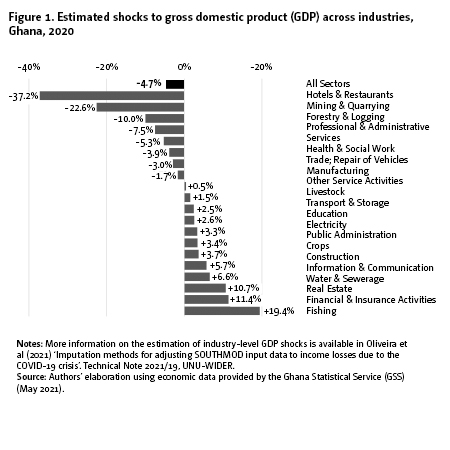

As expected, the hotels and restaurants industry was affected most severely (Figure 1), given the partial lockdown measures and the near halt of (inter)national tourism. Similarly, services more generally and manufacturing suffered. These shocks are estimated by simply calculating for the overall economy and each sector, how far developments in 2020 deviated from their pre-pandemic growth trend between 2017–2019. Although this simple approach is chosen to reflect general trends observed for each industry, it might also capture other effects in addition to the pandemic. For example, more stringent measures to address the environmental concerns have put pressures on the mining and forestry industries.

Agricultural activities such as fishing and crop farming that are critical for the livelihoods of a large share of the population deviated in positive terms. Some further sectors such as construction, information technology and communication, outperformed their pre-pandemic trends.

These macroeconomic shocks are then translated to individuals’ incomes and reflected in the microlevel survey data used by the GHAMOD model.

Overall increase in poverty and inequality

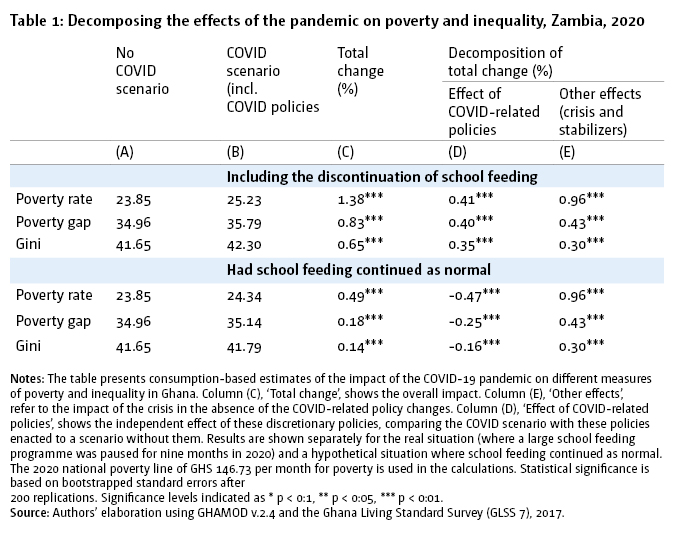

Despite the various discretionary policies implemented, simulations point to an increase in poverty and inequality (see Table 1, top panel). Comparing poverty headcount ratios between the scenario without COVID-19 (column A) and the scenario with COVID-19 (column B), the poverty headcount increases from 23.85% to 25.23% in each case respectively which equates to a relative increase of 1.38 percentage points. According to the analysis the poverty gap and inequality have also increased.

Most discretionary measures well-targeted to vulnerable households but negative impact of pausing school feeding trumps beneficial impacts

Pausing the school feeding programme during lockdown accounts for the negative effect of COVID-related policies on poverty. With children not in school households had to provide additional meals, simulated here as GHS1.20 per each day a child goes to public school, equal to the value of the school meal. Had school feeding continued as normal (lower panel in Table 1), the poverty increase would have been less than half, and the poverty gap and inequality would have also increased considerably less. The combined buffering impact of all measures taken to protect households was not strong enough to offset this negative impact.

The additional LEAP benefits, waivers/reduction of utility fees, and the school feeding programme that eventually was started for a portion of students mainly supported the incomes of households in the lowest quartile of the income distribution. Due to data limitations modelling other measures relevant to households such as support to small and medium sized businesses, was not possible. Simulation of the electricity waiver by 50% is partial and results might therefore underestimate the income support provided to those households higher up in the middle of the income distribution.

No buffering of incomes through the general tax-benefit system

The general tax-benefit system as it existed before the crisis barely protected incomes automatically in response to households’ falling incomes. The so-called automatic stabilizers operate either through lower tax and social security payments to the government when earnings fall, or through increased benefits.

Sanitary health measures taken in response to the COVID-19 pandemic (such as lockdowns) can pose a veritable challenge for the successful delivery of existing social protection programmes

Efforts to increase the formal economy, for example through digitalization will pay in the long run, by improving resilience to future shocks

Careful consideration of innovative social protection systems designed to deliver quick additional relief in times of crisis, and provision of social protection floor benefits is necessary

Filling the data gaps (such as the National Household Register) are critical as that should enable better targeting and quicker response to such covariate shocks

The failure of the general tax-benefit system during the crisis is explained by two factors: First, the large informal economy means that few people pay income tax and social insurance payments and therefore most cannot benefit from reduced payments to government when their earnings fall. Only those in the formal sector, usually situated in the upper part of the income distribution, benefit from this mechanism.

Second, current safety nets (e.g., LEAP) determine eligibility in a rather static manner and do not react to income shocks. In addition, current safety nets are limited in their coverage.

Join the network

Join the network